I want to learn more about Agile Energy X, a company that has incorporated Bitcoin mining into its business!

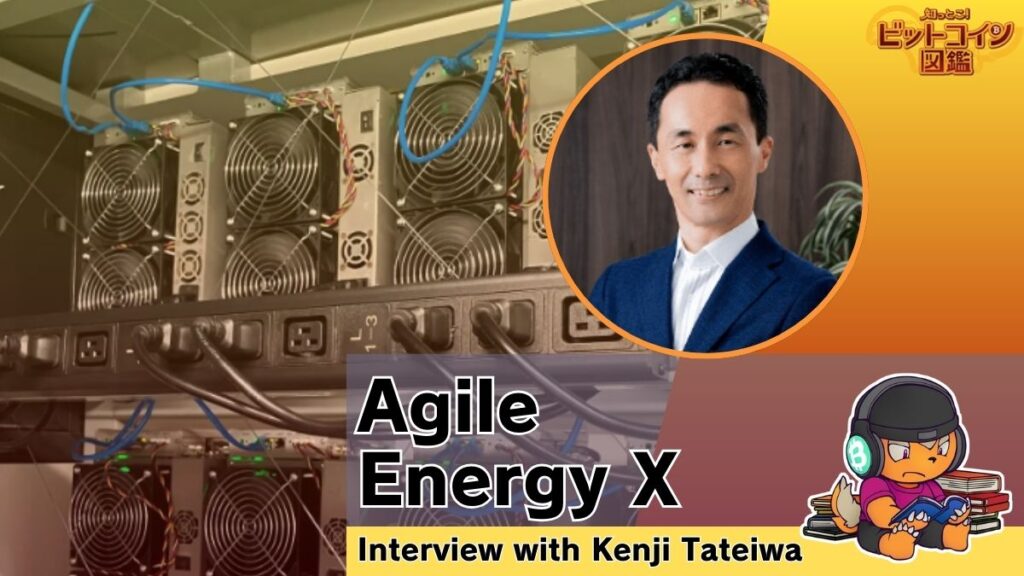

Agile Energy X is a company aiming to maximize the integration of renewable energy and optimize the power grid.

A 100% subsidiary of TEPCO, Agile Energy X’s unique system that combines renewable energy and mining has drawn attention both domestically and internationally.

This article summarizes the conversation I had with Kenji Tateiwa, President of Agile Energy X.

I asked him some honest questions and shared my thoughts on their business, so I hope you’ll read until the end!

You can listen to the conversation between Kenji Tateiwa and the author (Minami) in the following podcast.

https://open.spotify.com/episode/7h5JQiBW0uLLMErrK52JNK

If you’d like to learn more about what kind of business Agile Energy X is engaged in, please check out the article below first.

Related article : What is Agile Energy X? Bitcoin Mining Operated by a Subsidiary of TEPCO in Japan

Is Agile Energy X Difficult to Explain?

Tateiwa-san, you’ve been interviewed on various YouTube channels focused on the environment, decarbonization, and local topics.

In those interviews, I noticed you don’t push the Bitcoin angle too strongly and instead mention, "This is not a business to make money with Bitcoin."

However, there are people interested in Bitcoin who may be expecting to hear about money-making opportunities. I feel like that makes marketing a bit tricky—what are your thoughts on that?

Thank you.

We’re not a company that sells a product, so we don’t really need marketing.

Tateiwa-san: We’re developing solutions to address energy problems, but it’s not about selling these solutions to someone.

There are two main pillars to our business.

The first is using Bitcoin mining as a method to make use of surplus renewable energy. However, we’re not selling mining equipment to others.

Agile Energy X owns the mining equipment itself, procures unused renewable energy, and conducts Bitcoin mining with that energy as part of our business model.

We don’t need to persuade anyone that "Bitcoin is amazing."

Wherever there’s surplus electricity, we approach them and suggest collaborating to monetize the unused energy.

That’s one part of our business.

The other part is a bit harder to explain. It addresses a challenge faced by power companies called "grid congestion."

They want to connect more renewable energy to the grid, but there’s a limit to the grid’s capacity, which makes it difficult to integrate more.

To expand the grid’s capacity, transmission and distribution companies (general transmission and distribution operators) would need to invest in infrastructure upgrades, but that takes an enormous amount of time and money.

In the end, the cost of these upgrades gets passed on to customers in the form of higher electricity prices.

Instead of upgrading the infrastructure, we propose using Bitcoin mining equipment to absorb the excess electricity that can’t be fed into the grid, which helps reduce electricity costs.

This is another part of our business.

Again, we’re not selling Bitcoin mining equipment to anyone. Agile Energy X owns the equipment and absorbs the excess electricity that the grid can’t handle, ultimately helping to reduce electricity costs.

That’s our business model.

Therefore, there’s no need to promote the idea that "Bitcoin is a good asset and will increase in value."

Our goal is simply to run a business that efficiently absorbs electricity, with a clear understanding of Bitcoin and its role.

As for the message we’re sharing through platforms like YouTube, we aim to communicate that "Bitcoin isn’t a bad thing, and while Bitcoin mining equipment consumes a lot of electricity, it’s being put to good use, so there’s no need to worry." That’s the position we take when we speak in public.

Tateiwa-san has also appeared on Stephan Livera’s podcast.

About Agile Energy X’s Business Activities

I’m going to ask a few questions about Agile Energy X’s business that I’ve been curious about!

- Is the business model based on subsidies?

- Do mining machines need to be replaced every 4 to 6 years?

- Mining Operators Withdrawing from Business During Major Price Crashes

- Is there a possibility of mining other altcoins?

- Is the halving a significant event?

Is the business model based on subsidies?

Some Bitcoiners view government subsidy policies as simply "throwing money around."

I’ve heard that renewable energy receives subsidies—does Agile Energy X’s business depend on subsidies?

It’s not based on subsidies.

We don’t believe a business dependent on subsidies is a real business, so we’re not relying on them.

It’s not based on subsidies.

However, that’s not to say we won’t use subsidies at all. If an opportunity arises where they’re available, we wouldn’t reject them outright.

To explain further, looking at the long-term goal of achieving carbon neutrality by 2050, as part of the national policy, there will be a significant increase in renewable energy.

This will inevitably lead to a massive amount of surplus renewable energy, and Bitcoin mining is one flexible demand solution to prevent that energy from going to waste.

Other options, like AI data centers, could also provide flexible demand, and we’d certainly consider those.

But for now, the most promising flexible demand solution is Bitcoin mining, which can use that surplus renewable energy.

That’s our future vision, and we’re not planning to rely on subsidies for that.

Currently, there’s another movement where various municipalities are pushing for decarbonization.

Under the national policy for decarbonization, certain regions can use subsidies or grants to promote this initiative.

In this context, we often hear from municipalities saying, "We want to promote decarbonization, and we have plenty of space to install solar panels, but (especially in rural areas) we don’t have enough demand to fully utilize the solar power, and that’s a problem."

So, we’ve been approached with requests to bring Agile Energy X’s solution as a way to effectively use the solar power they’ve installed.

In those cases, if the municipality is already eligible for decarbonization subsidies or other programs, we are open to collaborating and helping promote decarbonization efforts as part of that larger initiative.

However, this isn’t about chasing subsidies. Even without us, these municipalities would still be moving forward with decarbonization using national funds. We’re simply offering our support.

That’s the approach we’re taking.

Do mining machines need to be replaced every 4 to 6 years?

I’ve heard that mining machines generally need to be replaced every 4 to 6 years.

Is that true, and does this mean they need to be replaced every time?

Generally speaking, the 4-6 year timeframe isn’t so much because the machines will "probably break by then."

Instead, it’s more that after 4-6 years, newer, more competitive machines will appear, and the older machines will become less profitable, so they’ll be retired due to their "economic lifespan."

In Agile Energy X’s case, when it comes to making profits through Bitcoin mining, I believe we’ll face similar challenges.

However, what sets us apart from regular Bitcoin mining businesses is that one of our pillars is to use surplus renewable energy for Bitcoin mining.

In this model, after 4-5 years, when a machine becomes less profitable, it will need to be retired, similar to other mining businesses.

But here’s where we differ:

In the second pillar of our business, which focuses on easing grid congestion, there’s value in absorbing surplus renewable energy that can’t be fully utilized by the power grid.

So, even if a machine has been running for 4-5 years and is no longer profitable from a Bitcoin mining perspective, it can still serve a purpose in absorbing this surplus energy, as long as it’s physically functional.

Simply absorbing electricity and turning it into heat would create no value. However, even an outdated machine from 4-5 years ago can still produce some Bitcoin.

While it might not be profitable on its own, it still provides value in terms of easing grid congestion.

In that sense, we’re considering a "double cropping" for mining equipment.

First, we’ll use the machines to earn Bitcoin from surplus renewable energy for 4-5 years.

Then, when their profitability for Bitcoin mining declines, we’ll repurpose them to help ease grid congestion by absorbing excess electricity, and they’ll continue to be useful until they physically break down.

That’s how we envision giving mining equipment a "double cropping."

Double cropping of Mining Equipment! That sounds interesting!

Mining Operators Withdrawing from Business During Major Price Crashes

I often hear about overseas mining companies that can’t withstand Bitcoin price crashes and have to withdraw from the business.

Does Agile Energy X have a different business model from that?

That’s correct. Pure-play Bitcoin mining companies rely heavily on the price of Bitcoin (or more specifically, the ups and downs of the hash price).

When the hash price drops, their profitability decreases, and their business becomes unsustainable—a very volatile business.

In Agile Energy X’s case, while we do have some exposure to these challenges, our grid congestion mitigation business doesn’t depend on the hash price at all.

In fact, when the hash price drops and pure-play mining businesses become less profitable, the price of mining machines also falls.

This allows us to cheaply acquire machines that are still functional but not highly profitable, enabling us to mitigate grid congestion at a lower cost.

In this way, our business model offers a hedge against price volatility.

Is there a possibility of mining other altcoins?

Is the halving a significant event?

MARA, an overseas mining company, mines altcoins in addition to Bitcoin.

Is Agile Energy X considering the possibility of mining altcoins?

We’re not really considering it.

First of all, our goal isn’t to make money with Bitcoin but to solve energy problems. Our company was founded with the idea of finding the most efficient way to convert electricity into added value, and Bitcoin mining is one of the solutions we came to.

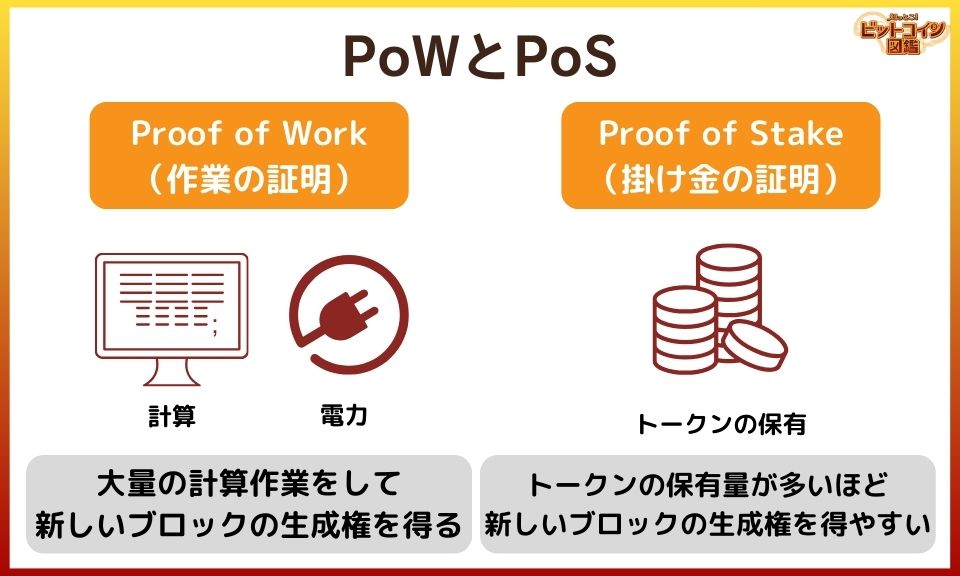

Our basic conclusion is that using Proof of Work (PoW) is the most flexible way to convert large amounts of electricity into added value, and one application of that is Bitcoin mining.

There are still a few altcoins that use PoW, although Ethereum has moved to Proof of Stake (PoS), meaning PoW altcoins are quite limited now.

Even if some altcoin mining were profitable in the short term, and since it uses PoW, it might appear to have the same effect as Bitcoin mining.

However, we are not considering altcoin mining because…

But when asked, "Why are you mining this altcoin?" I wouldn’t be able to confidently say, "This altcoin has intrinsic value." I don’t have enough understanding or conviction in any altcoins to say that, so we’re only focused on Bitcoin mining at the moment.

Hearing that makes me feel kind of happy!

In that sense, I also read The Bitcoin Standard this summer and it reaffirmed my belief that Bitcoin is a well-thought-out creation.

Of course, technological innovation will continue.

If, at some point, a "second Bitcoin" comes along—an altcoin that is well-designed, has intrinsic value, and benefits society—I wouldn’t rule it out. But at the moment, I haven’t encountered such a coin.

So, if a second Bitcoin Standard or an "Altcoin Standard" book comes out, backed by solid theory and years of proven success like Bitcoin, then I think it would be worth considering.

But for now, no such coin exists, and I don’t see any likely candidates in the near future.

Is the business model based on subsidies?

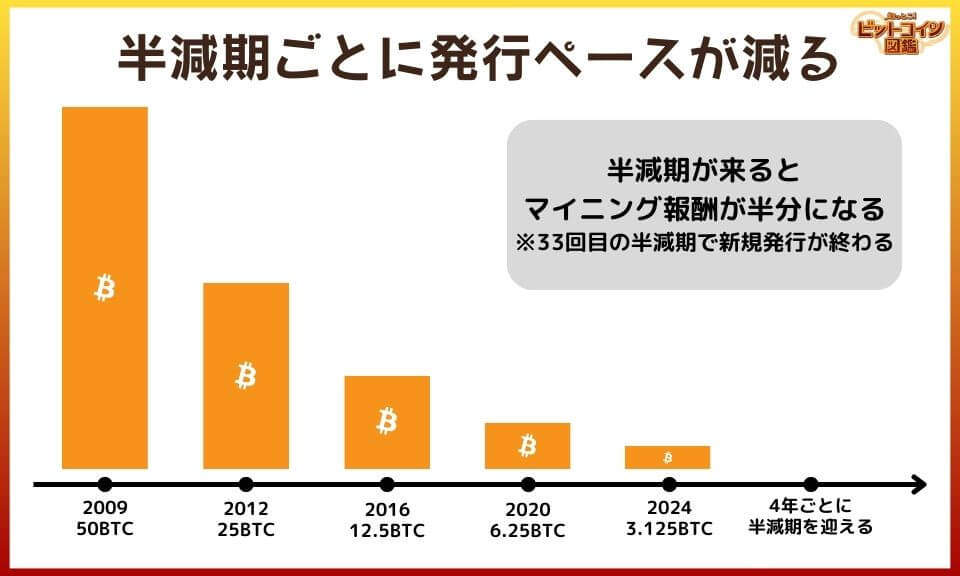

The halving reduces the issuance rate every time it happens.

Mining rewards get halved with each Bitcoin halving, which is a big event for mining companies. But is it also a major event for Agile Energy X?

For example, in April this year, the reward halved from 6.25 BTC to 3.125 BTC. Was there anything notable around that time?

No, there wasn’t.

The reason I can say that is because, at this point, our income from Bitcoin mining is nearly negligible.

We founded the company in August 2022 and started operations in October 2022.

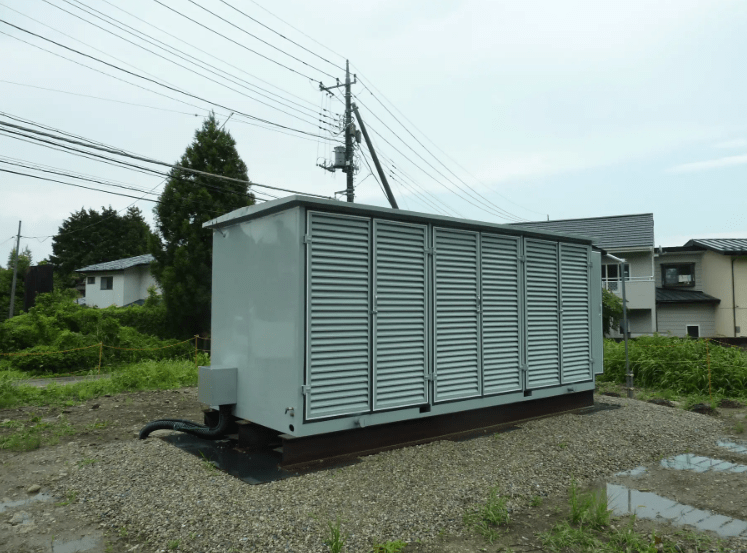

We have two locations—in Nasushiobara, Tochigi Prefecture, and Showa Village, Gunma Prefecture—where we’ve installed 50 kW containers with mining equipment.

We only operate the Showa Village site regularly, using solar power. When the 50 kW solar power plant is active during the day, all the electricity is automatically consumed by the Bitcoin mining equipment and converted into Bitcoin.

However, since it’s solar power, the annual operating rate is low, and with just 50 kW of mining equipment, the amount of Bitcoin earned is minimal.

Power plants typically generate in megawatts (MW) or gigawatts (GW), so 50 kW is indeed small-scale.

The site in Nasushiobara, Tochigi Prefecture, is used for a demonstration to draw electricity directly from power lines, but it’s usually inactive, so we earn very little Bitcoin from that site.

So, when the halving occurred in April this year, the Bitcoin earned at the Showa Village site was indeed halved, but since the amount was small to begin with, halving it didn’t have much of an impact. It’s not great, but we weren’t relying on it anyway.

Of course, we don’t intend to stop at just 50 kW.

To truly solve Japan’s energy problems using Bitcoin mining equipment, we’ll need to scale up to hundreds of megawatts or even gigawatt-scale flexible power demand facilities.

At that point, the halving—which halves the mining reward—will have a bigger impact.

However, as I mentioned earlier, since we aren’t pure-play miners, the grid congestion mitigation part of our business won’t be affected by the halving. So, we can hedge a significant portion of the impact from the halving.

About Nuclear Power Generation

Tateiwa-san, you’re very knowledgeable about nuclear power, so I’d like to hear more about it!

- Can Agile Energy X’s system work with nuclear power?

- Bitcoin mining powered by nuclear energy

- Differences in public perception of nuclear power between Japan and overseas

Can Agile Energy X’s system work with nuclear power?

Can Agile Energy X’s system also work with electricity generated by nuclear power?

Yes, it can.

We’ve developed solutions to create flexible power demand, regardless of the power source, and one of those solutions is Bitcoin mining.

Globally, most Bitcoin mining operators run their operations continuously as baseload power.

Most mining operators aim to run with as high an operating rate as possible. Some even place mining equipment near hydropower plants and run them continuously.

Recently, in Pennsylvania, USA, there’s a company running a 300-megawatt mining operation on-site at a nuclear power plant, using nuclear-generated electricity to power their mining equipment.

Whether it’s nuclear, hydropower, solar, wind, or fossil fuel, Bitcoin mining equipment can convert electricity into digital value, so it’s a technology that can be used with any power source.

However, as for whether Agile Energy X will use nuclear power for Bitcoin mining in Japan, currently, there’s no surplus nuclear power available in Japan, so there’s no value in doing that at the moment.

Right now, what holds value is the effective use of surplus renewable energy that would otherwise go to waste, which is a social issue that needs to be addressed. That’s where our focus lies.

But technically, we can monetize any type of electricity.

Bitcoin mining powered by nuclear energy

I’ve heard that research into mining with nuclear power is being conducted overseas, but is that not really happening in Japan yet?

That’s correct. There’s no particular demand to specifically purchase nuclear electricity for Bitcoin mining in Japan right now.

However, in the long term, if Japan aims to achieve its national policy goal of carbon neutrality by 2050, renewable energy alone won’t suffice as a baseload power source. A realistic solution would be to combine renewable energy with nuclear power to achieve carbon neutrality.

When combining variable renewable energy with nuclear power, there’s a possibility that during periods of electricity oversupply, we might have to curtail not only renewable energy output but also nuclear energy.

Ideally, nuclear power operates continuously at 100% capacity, as it’s more economical and safer not to change the output.

But in cases of oversupply, rather than shutting down the nuclear plant, we could absorb the excess electricity with flexible demand facilities like Bitcoin mining, allowing the nuclear plant to continue operating at 100%.

In the long term, this could also become necessary in Japan, and when that happens, Bitcoin mining could play a helpful role.

I recently heard about "micro-reactors," which are extremely small nuclear reactors, about 2m x 1m in size, that are being developed in Japan.

They’re being designed to be built in factories and transported by truck, with the possibility of using them for power generation on remote islands. It seems like there could be situations where electricity would be in surplus.

It seems like Bitcoin mining could be a great match for that.

That’s right. I don’t think micro-reactor development is progressing much in Japan at the moment.

However, overseas, this concept is being explored.

Before micro-reactors, there’s already a global boom in small modular reactors (SMRs).

Today, there was news about Amazon investing in an SMR company, and a while ago, there was an article about Google either ordering a small reactor or planning to purchase its electricity.

Compared to the large nuclear reactors we have now, SMRs (small modular reactors) are much smaller in size, and they’re being developed worldwide, with venture companies raising funds for them.

That’s the trend at the moment.

In the long term, there will likely also be demand for even smaller micro-reactors.

On remote islands, we could install small nuclear reactors or micro-reactors, use them for Bitcoin mining, and also produce hydrogen through electrolysis of water using nuclear power. We could even combine hydrogen with renewable ammonia to create energy carriers, transport them to mainland Japan, and burn them in thermal power plants.

I think this transition to a new energy infrastructure will be necessary in the future.

Differences in public perception of nuclear power between Japan and overseas

I’d like to ask about public perception of nuclear power as well. In Japan, is it generally viewed more negatively than it is overseas?

Yes, that’s true.

Japan experienced the Fukushima Daiichi nuclear disaster after the Great East Japan Earthquake, so it’s understandable that there are cautious opinions about nuclear power.

There are, of course, various opinions in different countries, but the recent trend in many nations is to recognize the necessity of nuclear power.

As demand for electricity from data centers increases, there’s growing reliance on and expectations for nuclear power, especially overseas.

When you search for information about nuclear power online, a lot of the results are negative, with words like "failure" being common.

Looking at that, I was reminded of Bitcoin.

Tateiwa-san, you’re involved in both nuclear power and Bitcoin.

It seems like it must be tough dealing with media coverage and public perception on both fronts. Do you feel that way sometimes?

Thank you. Yes, exactly. Both nuclear power and Bitcoin are technologies or themes that evoke a wide range of emotions.

In 2018, I came up with the business idea that connects to Agile Energy X.

While researching, I found that many people—both directly and indirectly—working in Bitcoin mining, especially in overseas podcasts I listened to, said that Bitcoin mining and nuclear power are the perfect combination.

They believe that combining CO2-free, stable, and low-cost nuclear power with Bitcoin mining is the most effective way to convert electricity into Bitcoin’s digital and financial value.

I thought that made a lot of sense, but at the same time, there are many people who hold negative feelings toward both technologies. So, how we communicate this is important and something to be cautious about.

However, I believe that if we can successfully advance this combination, it can solve many societal issues. It’s important to remain calm and constructive, engaging in dialogue and debate with people who hold various opinions, in order to use these technologies for the betterment of society.

This goes beyond just Bitcoin and nuclear power. It’s about combining various solutions to improve Japan and the world as a whole.

The Spread of Agile Energy X

I’m curious about how Agile Energy X will expand in the future, so I’d like to ask about it!

- Future projections

- The process for municipalities to adopt the system

Future projections

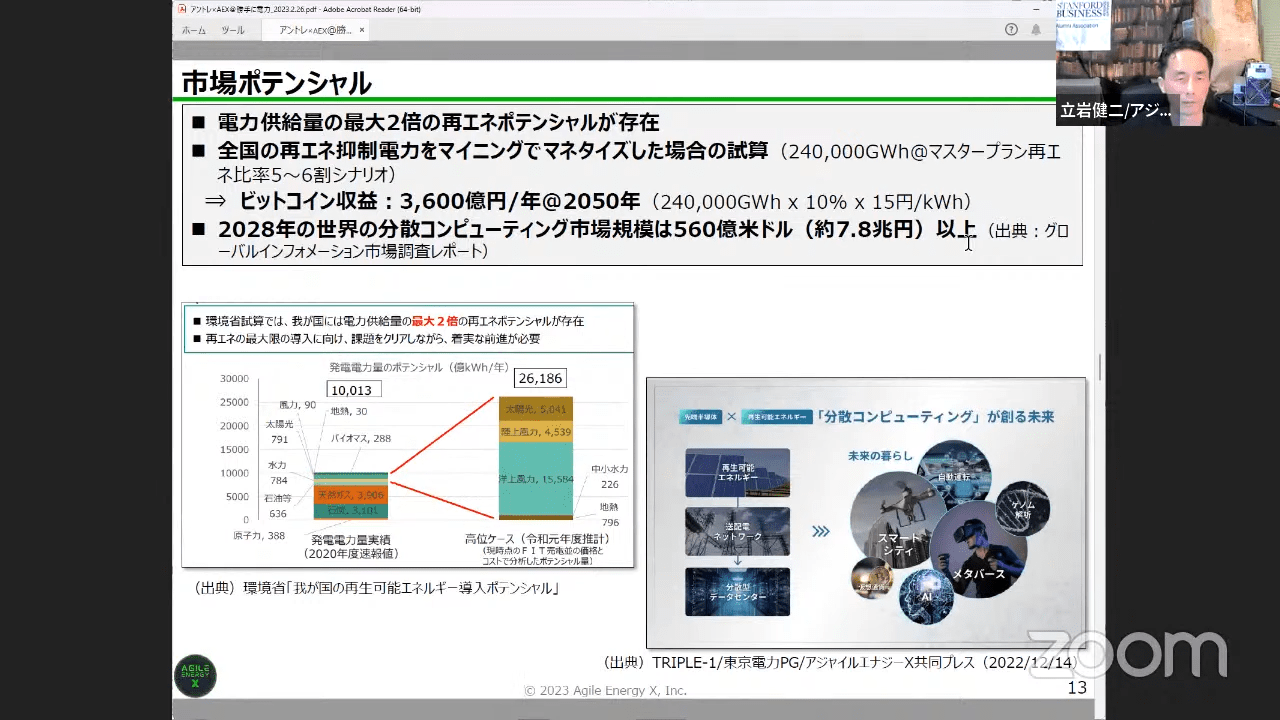

I saw data suggesting that if curtailed renewable energy across Japan is monetized through mining, "it could generate about 360 billion yen in annual mining revenue by 2050."

Is this based on the assumption that municipalities will steadily adopt Agile Energy X’s solution to make this achievable?

Actually, this projection isn’t based on municipalities adopting the solution…

This estimate is based on data from the Master Plan for Interregional Power Grid, which is a semi-public figure.

Essentially, by 2050, renewable energy is expected to account for about 50-60% of Japan’s energy mix, much of which will be variable sources like wind.

There’s a public scenario suggesting that "there could be a huge amount of wasted energy—about 240,000 GWh—that would have to be discarded."

Our projection of converting this wasted energy into Bitcoin mining revenue isn’t dependent on municipalities implementing it.

For simplicity’s sake, let’s assume Agile Energy X (though we don’t intend to monopolize this) could purchase 10% of that 240,000 GWh of wasted energy to run Bitcoin mining equipment.

Depending on the hash price at that time, if 1 kWh of electricity can be converted into 15 yen worth of Bitcoin, then the annual revenue could reach 360 billion yen—that’s the calculation.

Local governments are not involved in this.

Specifically, for example, if a large amount of offshore wind power was introduced to Hokkaido, and the necessary number of mining machines were placed in Hokkaido and the mining equipment absorbed the wind electricity that would have to be stopped by output controls, the figure would be something like this.

The process for municipalities to adopt the system

I’m curious, what would the process be like if a municipality were to adopt Agile Energy X’s system?

Does it take a lot of time to implement and achieve stable operation?

For example, if it takes around 10 years for one municipality to adopt the system, that seems like quite a long time.

I see.

First, if a municipality were to adopt the system, that would be part of helping solve the municipality's challenges, which is one aspect of what we aim to achieve.

While assisting municipalities with their carbon neutrality initiatives is one aspect, from the perspective of making effective use of unused renewable energy, municipalities don’t necessarily need to be directly involved.

Agile Energy X can collaborate with power generation companies introducing renewable energy to convert large amounts of wasted electricity into added value, such as Bitcoin mining. That’s the kind of partnership we envision.

Looking toward 2050, a vast amount of renewable energy sources will need to be introduced.

This will take years, as the construction of power plants is time-consuming.

However, once the power plants are built and large amounts of electricity from solar or wind sources start to be generated, if there’s no demand or the grid can’t absorb it, Agile Energy X can create the necessary demand.

In the case of Bitcoin mining, for example, the setup from installation to operation can be completed in a relatively short period.

For example, in the case of our 50 kW container project in Showa Village, Gunma Prefecture, although it was small-scale, it took just a few months from procurement to installation and operation.

When scaling up, of course, the time required increases accordingly.

However, even if we need to install, say, 100 megawatts of equipment in modular containers (such as 20-foot containers), it doesn’t take 100 times longer to install 100 sets than it does to install just one.

While it takes more time to install more units, it’s far from proportional.

For example, there are hundreds of megawatts of mining equipment operating in the U.S., and construction and installation likely take less than a year—even for large-scale setups, it might take about a year.

Compared to building a power plant, which takes many years, installing mining equipment is much quicker.

That’s one of the strengths of Bitcoin mining—it can be installed in a short time and starts operating right away.

If unused electricity decreases, the equipment can be reduced on a container-by-container basis, or even moved to another location.

I believe this flexibility is one of the strengths of Bitcoin mining.

That flexibility means there’s a possibility that more places will gradually adopt it.

Exactly.

There’s a lot of buzz around building AI data centers in Japan right now, and while those are necessary and valuable, a traditional data center is a project that takes many years to complete.

And predicting whether the demand for that data center will still exist years down the line is quite challenging.

Once built, it can’t easily be downsized, nor is it easy to move it.

With Bitcoin mining, however, you can install only the required number of units, reduce them one by one if needed, or even relocate them.

That flexibility is a valuable added feature.

AI data centers also consume a lot of power, so they could be a way to use excess electricity from renewable energy generation.

However, since these systems run 24/7 and require stable power, it may be necessary to combine renewable energy with other power sources, as renewable energy can be unstable.

Bitcoin mining, which can be turned ON and OFF as needed, has the advantage of efficiently absorbing surplus renewable energy.

I think that being container-based, it's easy to move and install, making it perfect for consuming surplus renewable energy in various regions without waste.

In Conclusion

I asked a lot of questions about Agile Energy X, and I was really happy that Tateiwa-san answered each one so thoroughly.

I hope more people learn about Agile Energy X’s efforts, and that the concept of Bitcoin mining combined with renewable energy gradually spreads in Japan!

It was clear that Tateiwa-san has a deep understanding of Bitcoin.

It’s really exciting to know that there’s someone so knowledgeable about Bitcoin among Japan’s energy industry specialists.

Tateiwa-san, thank you so much for taking the time to speak with me!

Agile Energy X Official Website

https://agileenergyx.co.jp/

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.

Recommended Articles:What is Bitcoin?

Recommended Articles:What is Bitcoin Tokyo 2024? An Overview of Japan's First Bitcoin-Focused Conference