Why is Bitcoin valuable?

Is it simply a coin to make money by buying and selling?

Bitcoin is invisible, digital money, and some people may think, "I don't really understand why anyone would want it.

The ups and downs of Bitcoin's price tend to attract attention, but what do experts think Bitcoin is worth?

This article is a written version of a video interview with bitcoin expert Koji Higashi.

He has been in the bitcoin business since 2014 and knows the transitions in the virtual currency industry very well, so please read to the end.

Supervisor: Koji Higashi

A pioneering figure in the domestic industry, engaged in Bitcoin-related businesses since the early days in 2014.

Co-founder of Diamond Hands/Operator of the YouTube channel "Bitcoiner's Hanseikai".

This article was written in Japanese and converted to English using a translation tool.

Date of writing (Japanese version): October 2023

How has the value of Bitcoin changed over time?

How has bitcoin been gaining value?

I heard the price has gone up more than before.

I understand that initially Bitcoin had almost no market value.

When bitcoin started in 2008, 2009 to be exact, there was a system called mining* from the beginning.

It has always been possible to generate new bitcoins by turning certain software on your own computer, or mining.

*Mining…a system where you perform the computational work required to approve transactions and receive bitcoins as a reward.

However, I am aware that for a while, people were just mining as a hobby, and there was no market for mining bitcoins, and no one was buying or selling, so there was no price.

I think for about two years, there was almost no market price.

When Bitcoin was born, it wasn't worth anything at all like it is today!

From there, little by little, in the beginning it was really just like a hobby, and small amounts of bitcoin started to be traded between individuals.

Little by little, more and more people became interested in bitcoin, and then there were services called exchanges, where people could buy and sell bitcoin.

At that time, there was a big exchange called Mt. Gox, and little by little the number of sellers and buyers increased, and the price went up, little by little.

The price goes up and down, but if you look at it from a long-term perspective, the price of bitcoin is going up.

Now, one bitcoin has a price of millions of yen on it.

I think a lot of people might want to go back a decade or more and buy bitcoin.

Why are bitcoins worth so much?

But why is bitcoin worth so much?

I said earlier that "various transactions occurred, buying and selling occurred, and prices started to come in," but why does "everyone want bitcoin" in the first place…?

Of course, it could be for investment purposes, or to make money from the price difference through buying and selling, of course.

To put it more clearly, the reason why we can say "Bitcoin has value" and talk about use cases, one is because "Bitcoin is a scarce digital asset (asset/property)".

Another is that it is very convenient for international or cross-border money transfers. I am one of those who have personally benefited from this.

Another is scalability. As a technology, it can be incorporated into various applications to create new business models.

Scarcity, remittance characteristics, and scalability.

I think these three are the main things that make it easy to understand.

Value of Bitcoin (1) Scarcity

Scarcity means something rare and hard to get, right?

Gold is often brought up in comparison to bitcoin when it comes to scarcity, and bitcoin is sometimes referred to as digital gold.

Bitcoin, by design, has an issuance limit of 21 million coins.

It also maintains a form of network with no governing body, and it is very difficult to change that maximum number of coins issued on its own, so it is effectively a system of scarcity.

Gold is similarly very scarce because there is a limit to the amount of gold that exists on the planet, and little by little it is being mined.

Resources that exist only in limited quantities are "wanted!" Many people feel that they "want it!

On the other hand, legal tender such as yen and dollar are basically issued by the government and the central bank. There is no limit to the supply, and they can print as many as they want.

Compared to legal tender, which has no scarcity, bitcoin, which has an issuance limit, may be healthier money.

Also, we are now seeing inflation of the Japanese yen and the depreciation of the yen, right?

Simply put, as a result of the central bank printing more and more yen, the value of each unit of yen is gradually decreasing.

When the value of the yen drops, in terms of whether to hold "legal tender that has no scarcity at all" or "bitcoin that has scarcity, or something like gold," I would say that bitcoin has value.

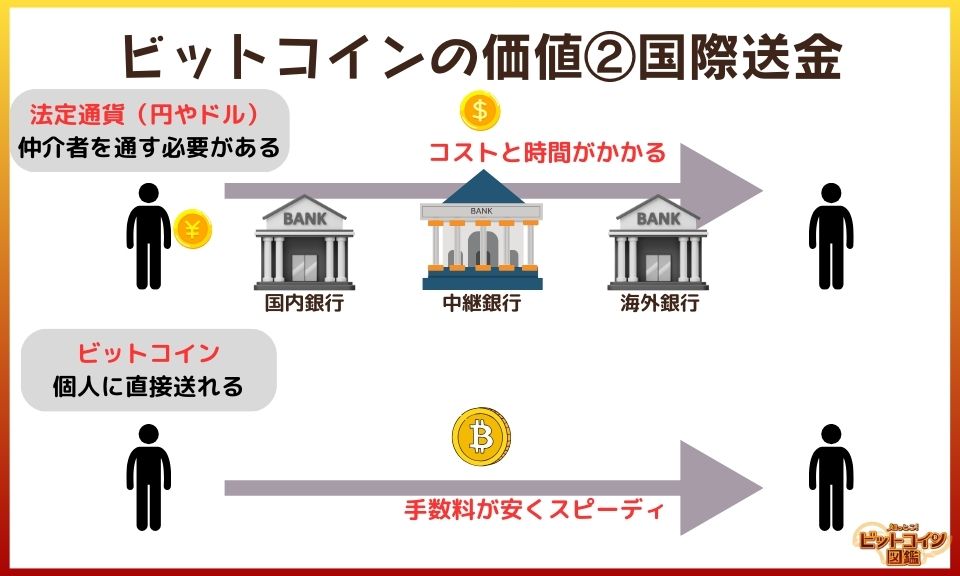

The Value of Bitcoin (2) International Remittance

I heard that you can use Bitcoin to pay at stores, so what if I use a payment service like PayPay?

Actually, that opinion is not wrong.

However, the time when Bitcoin is most likely to show its true value is when you send money across borders.

If you have ever done international money transfers at a bank, it might be easy to imagine.

After all, sending money from one country to another is very difficult, with various restrictions, time-consuming, and expensive.

Bitcoin, on the other hand, is not a network that depends on a specific country.

As long as you properly manage your private key, which is a kind of password, you can do it in Japan, in the US, in Europe, or in Africa. The ability to take your assets across countries in a digital form is a great feature and strength.

Not with bitcoin, but with a bank account, for example.

For example, I usually live in Taiwan, and it is very difficult and expensive to send money from Japan to Taiwan in a different way, such as transferring money to a bank account.

Being able to manage your own assets properly and being able to take them to any country in a portable manner is a very important feature, and I think it is a source of value.

Wow. That might be a bit useful.

I think this is a very easy-to-understand advantage for those who travel to various countries on business trips or for other reasons.

I often go on business trips to various countries myself, and even though I don't currently live in Japan, I find it useful as a way to manage my assets.

Value of Bitcoin (3) Scalability

By extensibility, do you mean that you can expand on the functionality you have now?

Yes, I think so. There is a lot of development going on to make it possible to use it in new ways and to process it more quickly.

Bitcoin is a technology for money transfer, but it is also the basis for various services such as payments.

Right now, for example, there's PayPay, PayPal, and many others. To put it simply, many of today's payment systems are not even good technically.

Credit cards in particular are based on old technology and are very complicated.

Bitcoin simplifies the old mechanism and allows Bitcoin to be integrated into various services.

An example is the use of micropayments (small payments). Using the service, a new business model can be built in which bitcoins of less than one yen can be sent or received instantly.

It can also be used as an entrepreneurial story or technology to improve services by incorporating bitcoin into more and more things.

Can you send bitcoins for less than a penny?

That means you can't do it with the technology we have.

Conventional payment services couldn't transfer or settle small amounts of money because the fees for sending too small amounts would be too high.

With Bitcoin's low-cost money transfer technology, you can send money directly to the person you want to send in seconds.

PayPay basically requires identification and a bank account to use it.

In contrast, Bitcoin can be used by anyone, and there is no prior identification or "please produce your passport" requirement.

The characteristic of easy use and access by anyone is an important feature and makes bitcoin valuable.

I think this is one of the reasons why Bitcoin has a different value, at least compared to other centralized, PayPay or financial services.

Bitcoin has no value backing?

What do you mean by backing of value?

The value endorsement is the reason or basis on which money or property is considered to have value.

People say things like, "Yen has an underlying value, but bitcoin is risky because it has no underlying value," or "You shouldn't invest in bitcoin."

That's one of the very common opinions. There are some parts that I can sort of understand and some parts that I feel there are many parts that I don't really see.

There are quite a few people who say, "Bitcoin has no value backing, but the yen does."

For example, "The yen has value because the government manages it, so the government will take care of it.

Or, "The yen is needed to pay taxes, so that's why it is backed by value.

I think this is because Japan has a somewhat well-functioning and functioning government, so everyone has trust in the government and feels that the yen has value.

And because the government has the ability to enforce the circulation of the yen and collect taxes (levy taxes), I think we can say that the Japanese yen has value and backing.

Yeah, I usually take the Japanese yen for granted, and I don't think it's particularly strange.

But if you look at various countries around the world, countries like Japan are quite a minority.

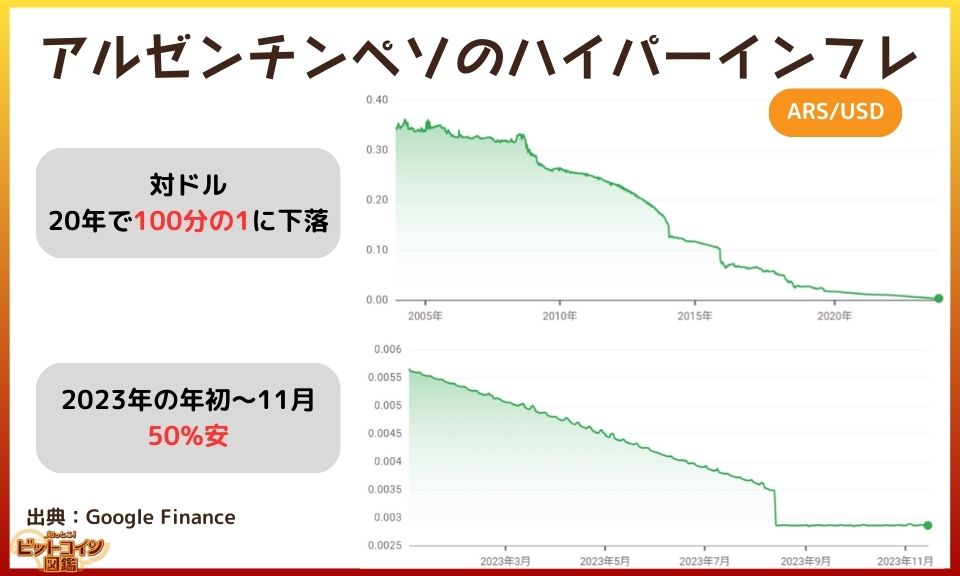

Even with government-controlled currencies, for example, the Turkish lira or the Argentine peso, the mechanism is basically the same.

There is a central bank and legal tender is issued.

However, because of the country's low credit rating, Argentina is in a state of hyperinflation right now.

For Argentines, legal tender is the one thing that has no underlying value.

So, one thing to remember is that Japanese and people from other countries "feel completely differently about the same legal tender.

Conversely, for people in Argentina, the question is, "Which is more backed by value, bitcoin or the Argentine peso?" Bitcoin seems to have more value, considering its scarcity, its ability to be transferred internationally, and the fact that it is an easily scalable technology.

I think this is due to the relative lack of trust in the government, but it is worth remembering one difference between Japan and other countries.

And since there are more countries in the world that do not have trust in their governments, currencies like bitcoin have at least some backing of value to them, and conversely, legal tender has no backing of value. That is what I am talking about.

So, I feel like a lot of people in Japan trust the government, and they don't want bitcoin, right?

You know, a lot of people might think, "Well, I feel like the yen has more value behind it."

I think that's certainly one of the stories.

It's an interesting story, too, and I don't think it's that everyone thinks that bitcoin is bad, but rather that there seems to be a pattern of people having that opinion because they don't know any better.

As for the yen, I think the value underpinning of trust in the government is actually fluffier than it seems.

The fact that gold, which is rare, has a price is also quite a difficult question to answer when you really think about why the value is backed up.

When you get down to it, I think what everyone is talking about is not so much whether or not there is an underpinning of value, but rather whether or not the underpinning of value is easy to see.

For example, if it is gold, it is easy to visualize because there is something like a gold bar.

If it is yen, it is easy to see because it is managed by the government, etc., and the backing of the value can be somehow felt.

Bitcoin, on the other hand, is not backed by a physical object, but by a digital object that uses the competitive principles of the market to create value.

This is not to say that there is no underpinning of value, but rather that it is difficult to understand the underpinning of value in the conventional sense. I feel that such an expression is more appropriate for me.

I think it is difficult to imagine this without understanding the bitcoin mining system and so on.

The point is that the proof of value is a lot fuzzier than you might think when you think about it calmly, and people usually just believe in what they see.

Just because Bitcoin is digitized and the value is hard to see does not mean that there is no value behind it.

There are many different use cases for bitcoin, and those are the underpinnings of value. I think the value endorsement is, in essence, "does anyone want it?"

If we were to ask, "Who do you want, the yen or bitcoin?" what would you think?

At the moment, I think most people in Japan are used to using yen and want it because it is somewhat reliable.

But I want bitcoin.

The reason why I want bitcoin is because the yen is being issued in ever-increasing amounts and is controlled by itself.

In fact, the yen has been weakening considerably, and I recognize that it is likely to continue to weaken in the future.

I think there are quite a few problems with the yen as a legal tender, such as inflation, etc. Compared to that, bitcoin is scarce.

For someone like me who travels to and from various countries, bitcoin is convenient. That's why I want it.

As long as there are people like me who want bitcoin as opposed to legal tender, I believe that is the underpinning of its value.

The underpinning of bitcoin's value is, in a sense, set against the health of legal tender.

Some people think that if the legal tender is not sound, that is the underpinning of the value of bitcoin.

Indeed, is it really safe to say that a lot of Japanese yen continues to be issued? You might think.

I see what you mean when you say that "whether or not there are people who want bitcoins" is the proof of value.

Yes, I agree. If there are more than a certain number of people who want bitcoin for some reason, that in a sense underpins, or supports, the value.

If you ask why people want bitcoin, that leads to the scarcity I talked about at the beginning, and so on.

There are a lot of people who criticize the lack of underpinning value. I can understand why some people criticize it because "there aren't too many stores where bitcoin can be used."

I think "why would someone want it?" and the mechanism by which it is backed up is an issue that should be considered, including the issues with legal tender.

Is there a possibility that bitcoin will lose its value in the future?

Many people around the world recognize the value of bitcoin, and a single coin has a price of several million yen, but….

Is there a possibility that bitcoin will lose its value in the future?

I think "losing value" is always a risk, not only for bitcoin, but also for yen, dollars, etc.

Especially since bitcoin is newer than the dollar, I think there is still a risk that something could go wrong and the price could go to zero, making it worthless, or in other words, "no one will want it or be able to use it at all".

However, we often hear that "if the U.S. government crushes bitcoin, it will be the end," but in fact, in the U.S., the government and existing finance are actually promoting bitcoin rather than the other way around.

Considering the incentives (motives) of politicians and existing finance, the incentive to destroy bitcoin is getting smaller and smaller.

Rather, there is a shift toward using and servicing bitcoin for their benefit.

If governments around the world cooperate, though, perhaps they could crush bitcoin.

That is politics, and I personally do not think that bitcoin can be crushed by political moves so easily, including dynamics such as one country promoting something and another banning it.

There are other aspects such as technical factors and competition from other coins, but I won't go into the details at this time.

It's always better to assume the possibility of Bitcoin losing value as an x-factor (one factor), though.

However, I feel that the risk of Bitcoin becoming completely worthless is gradually decreasing now that the Bitcoin technology is maturing and its use in various countries is accelerating.

Bitcoin is becoming easier to trade than ever before, as laws and regulations are being developed in many countries.

Institutional investors such as asset management companies are also beginning to invest in bitcoin, and bitcoin is gaining recognition as a common investment product.

What will happen to the value of Bitcoin in the future?

I wonder if the value of bitcoin will continue to be recognized by many people.

I'm also curious what the price will be.

Value and price are two slightly different things.

I guess people are more concerned about the price.

But I don't mean in the short term, such as price fluctuations, but in terms of value…

This may not be a direct answer, but I personally think about some of the possible changes that could occur as bitcoin becomes more prevalent in society in the future.

For example, it will become easier to cross borders and easier to send money across countries.

I also wonder if it has to do with improvements in AI and automatic translation technology, which could lead to further globalization.

On the other hand, factors such as wars could move in the opposite direction.

I also wonder if internationalization is one trend.

There are many countries where legal tender is not functioning well, so for people in those countries, it could be a new asset class that can protect their assets from inflation and other factors.

Bitcoin could become an important financial infrastructure for people in countries where legal tender is not functioning well.

Japan has one of the highest percentages of its population with bank accounts, but there are many people in the world who do not have access to financial services and do not have bank accounts.

I believe that people who have not had access to basic financial infrastructure will see their lives enriched by the use of bitcoin, and many other changes will occur.

Summary, Why Bitcoin has value.

Unlike the paper money we normally use, bitcoin has an issuance limit.

I've found that some people consider bitcoins to be more scarce than legal tender, which can be inflated by governments printing a lot of it.

Bitcoin can be conveniently used for international money transfers, and various services utilizing Bitcoin are also emerging.

If more people think that bitcoin will spread around the world in the future, there may be even more people who want to buy bitcoin.

I was kind of nervous about bitcoin because it sounds kind of difficult and I don't really know what it is, but I'd like to know a lot more about it.

I want to know more about Bitcoin!

ticles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.