What is the difference between bitcoin and altcoin?

Are they both the same?

Altcoin is a term for virtual currencies other than Bitcoin, and there are already more than tens of thousands of different types of altcoins.

There are many touted phrases such as "more powerful than Bitcoin" and "XX coin to buy now," but how do altcoins look from the perspective of Bitcoin experts?

This article is a written version of a video interview with bitcoin expert Koji Azuma.

Azuma has been in the bitcoin business since 2014 and knows the transitions in the virtual currency industry very well, so be sure to read to the end.

Supervisor: Koji Higashi

A pioneering figure in the domestic industry, engaged in Bitcoin-related businesses since the early days in 2014.

Co-founder of Diamond Hands/Operator of the YouTube channel "Bitcoiner's Hanseikai".

This article was written in Japanese and converted to English using a translation tool.

Date of writing (Japanese version): December 2023

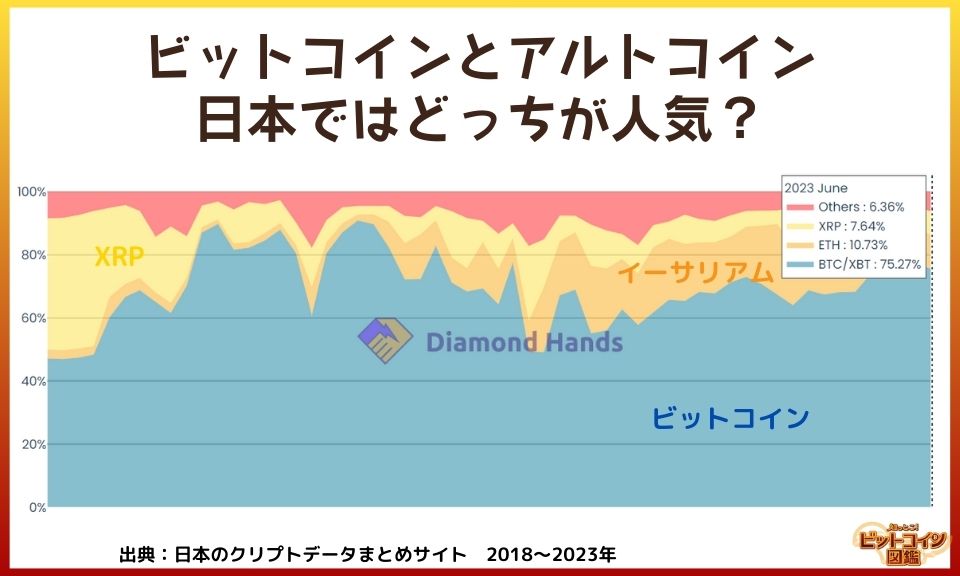

Bitcoin or Altcoin, Which is More Popular in Japan?

Bitcoin or altcoin, which is more popular in Japan?

It depends on how you look at it, but for example, in terms of trading volume, about 70% to 80% of physical transactions are bitcoin.

In terms of the number of users, bitcoin is definitely the most popular currency, if anything.

Higashi: At the same time, however, many people in Japan also buy other coins for trading and investment purposes, and I feel that the more novice people are, the more they invest in and buy various coins.

What is the difference between bitcoin and altcoin?

There are various types of altcoins, so it is difficult to make a general statement, but in general terms…

Higashi: First of all, decentralization* is one of the main differences between bitcoin and altcoin.

*The opposite of centralized, a system in which functions are distributed across multiple computers and other devices.

In some countries, legal treatment differs between bitcoin and others.

Purpose or what you ultimately want to do is another big difference between bitcoin and others.

There are also other differences in functionality and technical areas.

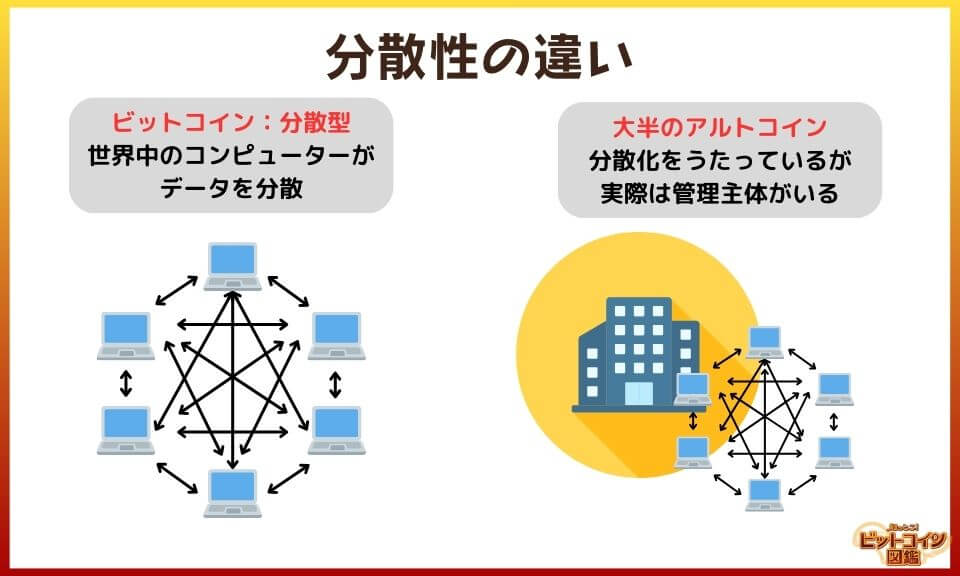

Differences in Decentralization

People may often say, "Bitcoin is decentralized," or "Virtual currencies in general are decentralized…"

In other words, I think the difference is "whether or not there is a managing entity (or someone managing it)".

One thing I'd like to say to beginners is that sometimes (media) articles or videos say "XX coins are decentralized…".

Decentralized is one of those things that is surprisingly difficult to evaluate or measure how decentralized it is from the outside.

To be honest, one thing to keep in mind is that most of the things that say things like "XX is decentralized and has no management entity" are actually things like "it's not decentralized, it has a management entity".

Bitcoin, on the other hand, has many factors, but it has the longest history, is the most stable, and is the most decentralized.

I think the difference is that Bitcoin is the most neutral and unaffected by any particular entity or company.

Conversely, altcoins are more about functionality and performance rather than decentralization, which I think is the main difference.

As to why having a managing entity is a problem, generally speaking, if it is managed by a well-known company, or by the government, or by other trusted people, it doesn't fail immediately even if there is a managing entity.

You may hear stories in the news about "a virtual currency theft" or "a virtual currency related company went bankrupt," etc. Simply put, this industry is still in its infancy in many places.

The industry is still in its infancy, and it is quite common for the main players to do wrong, commit crimes, or cheat users on a daily basis.

Therefore, in this industry, decentralization is the key to trust and security.

I think that's where bitcoin is differentiated and superior to altcoins.

If the companies issuing altcoins are doing something wrong, the public might not even notice, right?

The need to trust one company may indeed be different from bitcoin.

Bitcoin is distributed across more than 10,000 computers around the world, and it's a system without a central administrator.

While there are many altcoins whose founders have a strong influence, Bitcoin, whose founder is unknown, is different in nature.

Legal Differences

What does it mean that bitcoin and altcoin are legally different?

It depends on the country, but in countries like the U.S., there is a legal differentiation between securities and not securities based on who is managing them or not.

There are lawsuits going on just now in various places, and the SEC (the government organization that regulates securities) is suing various projects with arguments of the form, simply put, that virtual currency with a managing entity is a security.

There is no telling what the outcome of the lawsuit will be, but at least in countries like the U.S., bitcoin is not a security because there is no clear managing entity.

So they are often treated like commodities (natural products such as gold and silver).

In contrast, other coins may be viewed as being like securities/equities.

If they are considered securities or stocks, they are subject to various regulations, and the number of people who can use them may be restricted, or they may have to apply for and obtain permission for various things.

Legal treatment may change in such areas.

Basically, in this industry, if you are certified as a securities company, you are often subject to various restrictions, which are often not favorable.

On the other hand, in countries like Japan, the legal treatment of Bitcoin and other altcoins is actually the same.

It is important to keep in mind that there are differences in temperature and regulations depending on the country.

Unlike in the U.S., in Japan, bitcoin and altcoin are treated the same!

Yes, that's right. In Japan, on the contrary, the difference between Bitcoin and other coins is not so well understood, though it may be the case.

Basically, the U.S. is the center of many things, so if a particular coin is recognized as a security in the U.S. and is sued, for example, "You have to pay a fine," or "You can no longer trade this coin on an exchange," the price could go down as well.

So, as far as legal treatment, bitcoin is the safest and least risky.

In contrast, most of the other coins have unclear legal treatment.

Differences in Functionality

I often see altcoins that say things like, "It's faster than Bitcoin for sending money!" I often see altcoins like that, but what about the difference in functionality?

Functionality is one of the areas where altcoins often say they are "better than bitcoin".

There are a lot of trade-offs (incompatible relationships) with this, but I think in some limited areas it fits.

For example, I often say "smart contracts*".

*A system that automatically executes the contents of a contract.

You can write complex programs on the blockchain, and you can use them to provide transaction services, etc. The feature of smart contract-based chains is that a variety of services can be built on the blockchain.

The most famous and largest is Ethereum, and there are many other similar chains out there.

Bitcoin, on the other hand, has often taken a relatively conservative approach.

The ability to do smart contracts has its advantages in terms of performance, but at the same time it carries the risk of being attacked from the outside, or having your money stolen when the program makes an unexpected move.

There is a tradeoff, and bitcoin is more about constraining the functionality of what can be done on the blockchain so that it is more conservative, more secure, and safer to use as money.

In terms of functionality, I would say that the newer blockchains have more features, or are faster, or can generate transactions (transaction processing) more cheaply, and so on.

There is a trade-off relationship there, and there are ongoing efforts to improve the performance and functionality of bitcoin using technologies, approaches, etc. that are referred to as layer 2* in bitcoin.

*Refers to technology that supports the main blockchain and makes it easier to use.

This is my own personal opinion, but even with bitcoin, things like smart contracts will eventually become possible, and such efforts are underway.

In terms of functionality, will bitcoin make up the difference?

Well, it's a trade-off, but there is a trend that bitcoin will evolve in terms of functionality as well.

Different Purposes

There are many different purposes for altcoins in general, for example, coins aimed at improving privacy. There are so many different initiatives and experiments that it's hard to generalize.

But if there is a difference in purpose between bitcoin and other coins…

Bitcoin has had the strongest emphasis on decentralization since its anonymous founder, Satoshi Nakamoto, released and announced Bitcoin.

In short, there is no governing body, and it is money on the Internet that is neutral, which is very important.

In contrast, many altcoins are actually not very decentralized and can be said to have a managing entity.

Many of the coins are better suited for storing value like bitcoin, and can be viewed more like stocks, rather than money like digital gold or "new money/digital money".

In short, it's like a specific company or developer working hard to develop the blockchain, offering various features, and as the number of users increases, the price goes up.

For better or worse, it's more like a startup (a company launching a new business).

Bitcoin, on the other hand, is more like a natural product or digital gold than a startup, and I think that's a big difference.

Bitcoin is aiming for a common protocol (standard), something like the Internet.

In contrast, altcoin people say things like, "It's decentralized," or "We are aiming to become something like the Internet," and so on.

The original purpose is quite different, like companies that are simply issuing coins as if they were startups.

Or venture capitalists (investment institutions) who are investing in companies are doing it to "make money", that's my honest opinion.

Differences in Ease of Doing Business

There are many aspects, but with the aspect of being able to do smart contracts, altcoins are easier to build various services, easier to take new initiatives, and easier to issue their own tokens.

In this regard, I think that altcoins are easier to work with and have a better development environment.

However, from a legal standpoint, especially in countries like the U.S., the regulatory treatment of Bitcoin and other coins may be completely different.

For example, there is a possibility that you will have to apply for some kind of license when you issue your own altcoins or start an altcoin-related project.

Bitcoin, on the other hand, is basically not subject to any separate new regulations if you incorporate Bitcoin payments into your service or that's all.

I think there are two sides to this issue: which one is easier to enter from a technical point of view, and the other is the legal treatment of bitcoin, which is quite important.

Difference in risk

In terms of risk, I think altcoins are clearly higher.

It is often said that virtual currencies are subject to extreme price volatility, and that some people gain while others lose when investing in them.

While this is true, bitcoin is still less volatile than altcoins. It is also relatively stable in terms of price.

I think the risk is not as high as other altcoins in terms of legal treatment and the ability to predict what will happen to some extent.

There is a culture that emphasizes technical aspects such as "is it very stable?" and "will it be attacked from the outside?" So I think the technical risk is also lower than with altcoins.

I think altcoins are high-risk, high-return, and have an aspect of being like a stock investment in a startup.

I think there are quite a few that temporarily outperform bitcoin in terms of price (good investment results) by riding a good trend well and investing in good stocks, or coins that "look like they are going to be exciting", so I think it's high risk/high return.

However, in the long run, over a 2-3 year period, or even longer, there are almost no coins that outperform bitcoin in terms of price.

From an investment standpoint, in terms of bitcoin and altcoin, bitcoin has better outperformance and lower risk in the long run.

In terms of risk, I think bitcoin is a few steps better for me, or maybe it's not that risky.

I think it's important to understand that bitcoin itself has its own risks.

I was under the impression that altcoins were more profitable, but I'm surprised that bitcoin is doing better in the long run!

There are some altcoins that soar in the short term, but it's mainly traders who are used to trading for the short term that can successfully make a profit.

If you're thinking of bitcoin as a long-term asset for the average person, bitcoin may be less risky.

Are some altcoins fraudulent or suspicious?

There are many that are fraudulent, to be honest.

The ones that are not decentralized actually have a purpose…of course they don't say that, but there are actually many cases where "the purpose of the people issuing the coins is to make money by selling them".

Whether that is legally fraudulent or not may be another discussion, but there are quite a few things that are clearly "the purpose of this is to sell out to some users" or "the purpose of the listing goal".

You should be careful with that.

Sell out… sell at a higher price before the market goes down.

Listing goal… the founder's ultimate goal is to go public (make the stock/virtual currency, etc. available for purchase on the market) rather than to improve the long-term value of the company in order to make a profit.

On the other hand, "our coin is better than bitcoin, it's decentralized, etc." is quite likely to contain lies, so you have to think about that and do your own research.

Fraudulent coins are getting better compared to the past, but there are still many.

Some are clearly fraudulent, and some are legal.

I often see that they are legally legal or in the gray zone, but the user is being encouraged to invest in a situation that is disadvantageous to them.

If the site looks official or says, "We are affiliated with a major company! I might believe it if it says "We are affiliated with a major company!

Some altcoins are doing a good job of promoting themselves by sending out ad requests to influential influencers.

Not everything written in official or media articles/social networking sites is correct, so you have to do your own research well.

When Bitcoin's price falls, why do altcoins fall in tandem?

It simply means that since bitcoin is the coin with the largest market capitalization, the other coins will follow there, basically.

In the past, the correlation between bitcoin and altcoins was higher, and the movement of bitcoin often pulled everything else down with it.

Recently, that trend has become a little less pronounced, but still, for some reason, other things are being pulled along by bitcoin, and that's how it seems.

Also, I think that altcoins are like startup investments, and there are aspects of them that are like stock investments.

If it were stocks, you would look at the financial results of each company and examine their performance, and there would be a correlation between the companies… If they are in the same industry, of course there would be a correlation, but if they are in different industries, there would not be much correlation, that is my understanding.

However, in the world of virtual currency, everything is influenced by bitcoin, including those that say "it is different from bitcoin" or "it is better than bitcoin.

In that sense, they are in a sense in competition with each other and correlated with each other.

That is why I said "Bitcoin and altcoins are different.

That's true from a bitcoin perspective, but altcoins are often just pulled by bitcoin in the end, price-wise.

So you're saying that as an investor, you recognize that they're all the same, and they often move in the same way.

What do you think about the correlation between bitcoin and altcoin prices?

There was a period in the first half of 2023 when bitcoin rose while altcoin prices were sluggish…

One is about regulation, one factor is that there are stricter securities regulations from the SEC (US regulator), there is uncertainty about altcoins other than bitcoin, and bitcoin is stronger as a price.

The other is the physical ETFs for bitcoin, and to put ETFs simply, there is a rapidly advancing environment in the U.S. that makes it easier for institutional investors to invest in bitcoin.

As for other altcoins, there has been no talk about ETFs at all.

Bitcoin is quite interesting right now to people on Wall Street and other existing financial people.

I feel that bitcoin has been particularly strong this year, partly because of the expectation of money coming in from these institutional investors.

ETFs…financial instruments listed on stock exchanges like stocks.

Institutional investors…Organizations that collect funds from their clients and manage large amounts of investments

Wall Street…the financial district in New York City

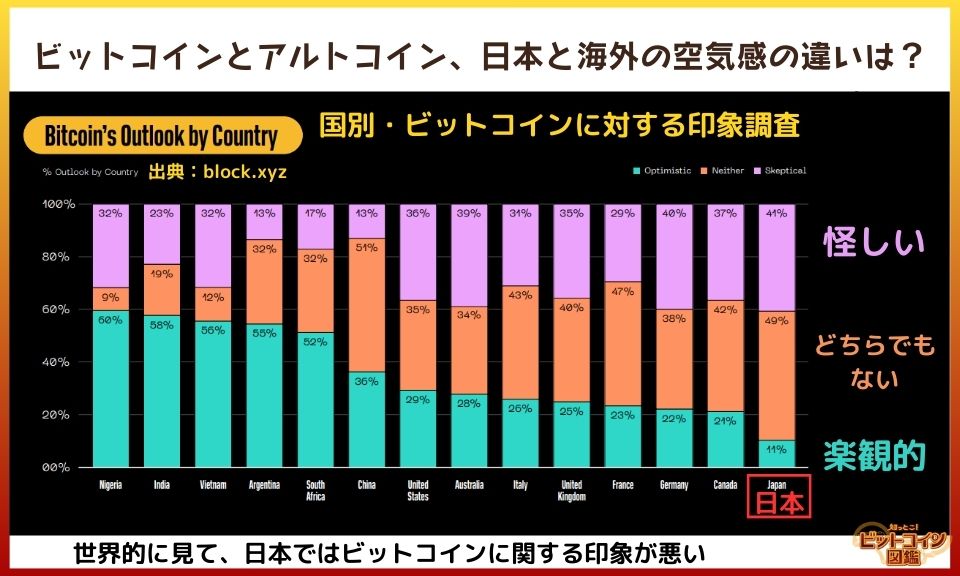

Bitcoin and Altcoin, What are the differences in the atmosphere between Japan and other countries?

Yes, I think they are quite different.

There are some surveys that show that Japan, in particular, is a country where people are more pessimistic in their perception of Bitcoin, compared to many other countries around the world.

It depends on the country. For example, Nigeria in Africa has a very high Bitcoin ownership rate and a weak local currency, so the awareness and expectations for Bitcoin are overwhelmingly higher than in Japan. There are countries like that.

Even in countries like the U.S., I believe there are many places where the perception of bitcoin differs from that of Japan.

In the U.S., there are discussions going on about the possibility of changing the legal treatment of bitcoin and other coins.

In other words, bitcoin is seen in the U.S. as a relatively low-risk, easy-to-reach virtual currency.

Other coins and bitcoin are perceived differently, in terms of risk and so on.

Another reason is that the mining industry is huge in the United States. The bitcoin mining industry*.

*A system in which the operator performs the computational work necessary to approve transactions and receives virtual currency as a reward.

In the U.S., there is a movement to separate Bitcoin from other altcoins, and politicians, existing financial institutions, and corporations are also involved and have high expectations for the Bitcoin industry.

In Japan, on the other hand, the legal aspects of Bitcoin and other cryptocurrencies are not so different, and the government is more concerned with Web3, so-called crypto, and other altcoin-related topics.

In short, there is a lot of talk about issuing tokens on their own and selling them.

So, I think it is a characteristic of Japan that people are getting excited about something different from Bitcoin.

Web3…A term used to mean "decentralized Internet utilizing blockchain technology," etc.

Crypto…meaning blockchain, virtual currency in general, etc.

NFT…a token that cannot be replaced and is used for digital data such as art and games

I see movements like Japan's in other Asian countries as well.

I go on business trips to many countries, and in Japan, yes, there is a relatively large user community and people who are involved in Bitcoin-related activities, as well as myself.

Bitcoin is the largest in terms of transaction volume, so there is an aspect that Bitcoin is popular.

The difference between Japan and the U.S. is that more people in the industry are concentrating on projects other than Bitcoin.

So many companies in other countries are looking to utilize bitcoin!

It's interesting to see how many companies in Japan are utilizing altcoins other than bitcoin or issuing new coins of their own.

What is the future of bitcoin and altcoins?

It's hard to say… you can make predictions about prices, for example, but to be honest, even if you make predictions, they often don't come true.

But it's not one of the relatively easy things to predict that bitcoin will be strong in terms of price for the next few months or year, including the ETF story.

And if you look at the longer term, if you look at it from a price standpoint, if you look at it over more than a few years, there are very few coins that have outperformed bitcoin prices over a 3, 5, or even longer period of time.

I think it's close to zero.

In other words, bitcoin is basically appropriate to work on or invest in with a long-term view.

Altcoins do go in and out of fashion, so when they become popular for a while, the number of users increases dramatically, the price rises, and they may collaborate with companies.

But when thinking about it from a long-term perspective, it's often very unclear how long they will survive.

In that respect, if I were asked to predict what Bitcoin will be like 10 years from now, I would say that there will probably be more users than there are now, various services will have been established, and various companies and other entities will hold Bitcoin.

Some countries have already made bitcoin a legal tender, or are strategically making it a legal tender, and there will probably be more and more examples of this.

It seems to me that bitcoin will become more popular, and I can say that with a lot of confidence.

As for other altcoins, there are very few coins that I can say the same thing with confidence, at least for me.

The only one that might have a chance is Ethereum, which is the biggest of the altcoins, has an active development ecosystem, and is differentiated from Bitcoin to some extent, so you might be able to make that prediction to some extent.

However, for the smaller altcoins, there are very few coins that have maintained their community and power for a long period of time.

I don't know what will happen, but if anything, I am pessimistic when compared to Bitcoin, and I think there are very few coins that have survived that long.

The longer I look at it, the more I think that way.

Summary, Difference between Bitcoin and Altcoin

There are many differences between bitcoin and altcoin!

In Japan, many people lump them together as "virtual currency," but I didn't know that there is a movement in some countries to consider them as different things.

I didn't know that some countries consider them different from one another. Bitcoin is a natural thing like gold, while altcoin is a coin issued by a company like stocks, which makes them seem completely different.

In Japan, there are people who think that virtual currencies and bitcoin are suspicious, or that if bitcoin's price goes up, other new 00 coins might go up as well.

I don't mean to deny altcoin investment, but if you are going to invest, it is important to examine carefully whether the coin is really diversified or not, as well as the regulatory aspects/risks.

I thought it might be important to know more about Bitcoin before getting into altcoins that I don't know much about.

I'd like to know more about Bitcoin!

Recommended Articles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.