What are the risks of investing in Bitcoin? I heard that new scams are on the rise recently…

Bitcoin has made technical advancements through major updates, but there are projects using these new technologies in ways that deviate from their original purpose.

Some projects aim to gather funds from users, and with the increasing attention on Bitcoin, the rise in scams is a concern.

In this article, I will introduce Bitcoin-related scam projects and the risks of investing in Bitcoin.

Summary of Key Points

- Be wary of Web3 projects claiming to be Bitcoin-related, such as "Bitcoin-related tokens" or "Layer 2," that aim to collect funds.

- Many fraudulent projects target people looking for the next big token after missing out on popular ones.

This article was written in Japanese and converted to English using a translation tool.

Date of writing (Japanese version): March 2024

Beware of projects using the name Bitcoin

I've heard that there are dangerous Bitcoin-related projects recently…

Yes, there are more projects using the high attention on Bitcoin to conduct marketing. There are Bitcoin-related tokens, airdrops, Layer 2 projects, etc. People interested in DeFi and NFTs should be particularly careful.

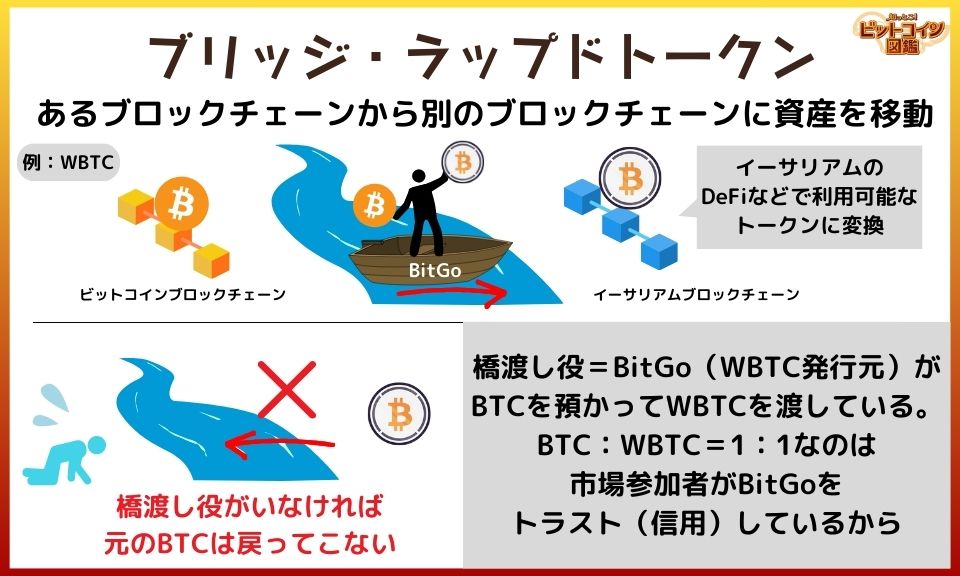

Risks of Bridges and Wrapped Tokens

A cryptocurrency bridge is an application that allows assets to be transferred from one blockchain to another.

When using a bridge, a process called "wrapping" occurs, creating a "wrapped token" that mirrors the original cryptocurrency's price.

Example of Bitcoin Wrapped Tokens: About WBTC

- BitGo (the company managing WBTC) holds BTC from users and provides an equivalent amount of WBTC.

→The BTC does not disappear; it is held by BitGo.

WBTC does not contain private keys. - The 1:1 price ratio relies on market participants trusting BitGo. If an issue arises at BitGo, this may no longer hold.

- WBTC lacks the strict finite supply characteristic of BTC.

In theory, BitGo could issue more than 21 million WBTC, though this is considered unlikely due to trust issues.

When converting Bitcoin to wrapped tokens via a bridge, the original Bitcoin is held by a central authority, concentrating Bitcoin in the bridge. Bridges have significant security challenges, and if the original Bitcoin is compromised, the resulting token could become worthless.

There is also a risk that the managing entity could abscond with the Bitcoin. The safety of the destination (like DeFi) for the converted tokens is also uncertain, putting Bitcoin at multiple risks.

Approximately 50% of DeFi Exploits Occur in Bridges (2020-2022)

🌉 Bridge exploits account for ~50% of all DeFi exploits, totaling ~$2.5B in lost assets

— Token Terminal (@tokenterminal) October 18, 2022

These hacks can typically be attributed to smart contract loopholes (e.g. Wormhole & Nomad) or compromised private keys (e.g. Ronin & Harmony).

What will it take to create secure bridges? pic.twitter.com/LrVf0W0zeK

Interview with BitGo Product Manager Kiarash

If the purpose is solely to hold Bitcoin, I don't think it should be tokenized. It should be held as Bitcoin.

However, the issue is that there is not much you can do with Bitcoin. You can either hold it for a certain period or use it for transactions.

The English translation is by the author.

Source:「なぜEthereum上でBitcoinを発行するのか」BitGo キアラシュ・モサイェリ氏 インタビュー

Moving assets across different blockchains is very complex and poses significant security challenges. Converting wrapped tokens back to Bitcoin can take considerable time, and your assets might remain held by the managing entity.

Recently, "Layer 2" and "sidechains" that bridge Bitcoin to other blockchains are being heavily promoted. Even if they are widespread on social media, it's crucial to understand the dangers of bridges first.

Besides hacking risks, insider fraud is also possible. Even if projects like "bridge & operate & airdrop for huge profits!" proliferate in the future, remember that there are significant risks involved.

Staking Risks

Staking involves depositing cryptocurrencies on the network to earn yields, and it is commonly practiced with PoS (Proof of Stake) cryptocurrencies like Ethereum.

Recently, platforms have emerged that convert Bitcoin into wrapped tokens for staking on other blockchains. However, Bitcoin staking relies heavily on trust in the wrapped tokens and the staking platforms.

It might be tempting to earn rewards by staking Bitcoin, but you never know what could happen to the bridge or the staking platform…

It's not worth risking your Bitcoin for a small yield.

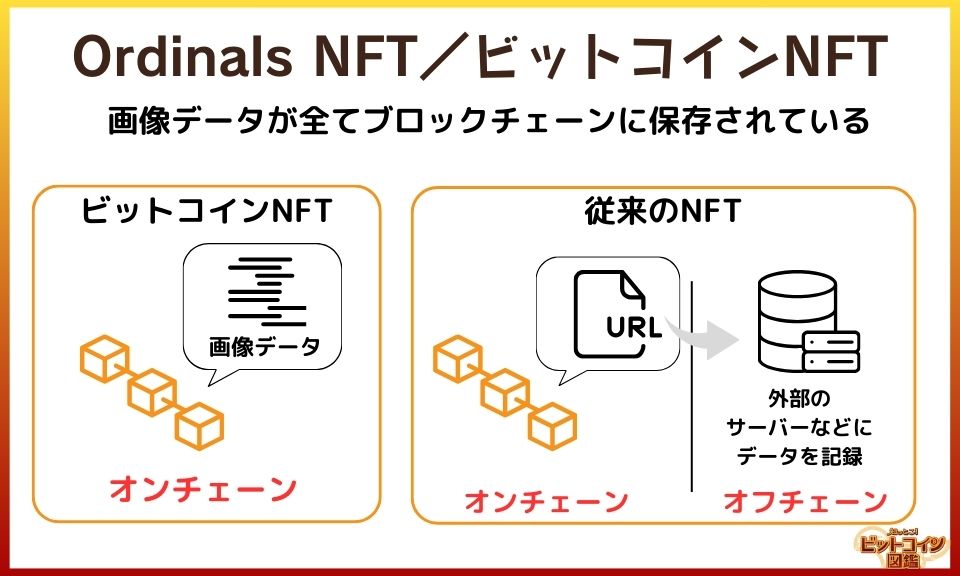

Risks of Ordinals NFTs

Ordinals NFTs are images or texts stored on the Bitcoin blockchain.

*NFT (Non-Fungible Token): Digital data created on a blockchain.

Ordinals NFTs have creators or project managers, and some projects engage in rug pulls (scamming by taking the money and leaving) or price manipulation after selling NFTs.

Just because an Ordinals NFT is made by a famous person or group, it doesn't mean you'll make a profit. Prices can crash dramatically…

NFTs have low liquidity and high price volatility. There is also a lot of speculative activity, so be cautious.

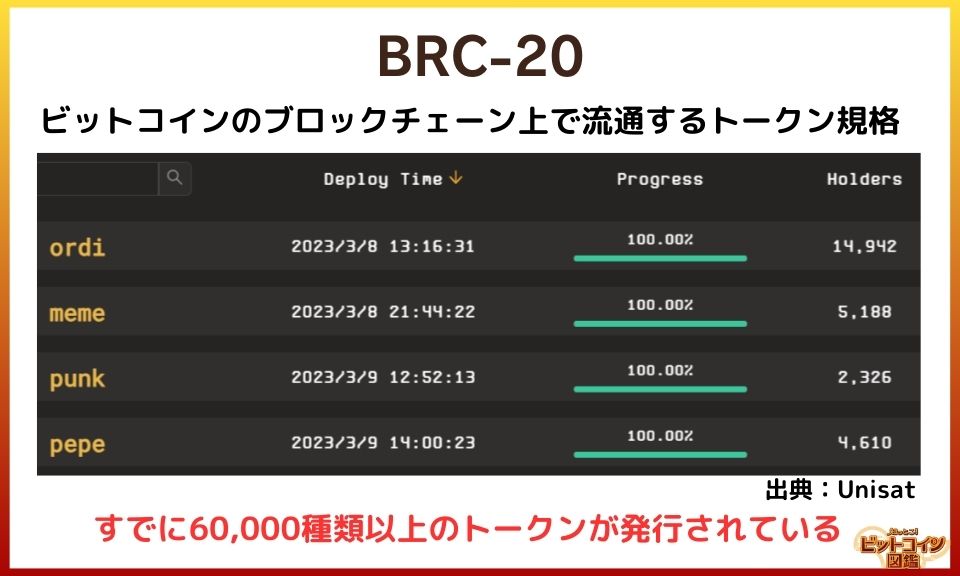

Risks of BRC-20 Tokens

BRC-20 is a token standard that circulates on the Bitcoin blockchain.

*Token standard: A set of rules for creating and managing tokens on a blockchain.

Without smart contract functionality or a clear use case, BRC-20 tokens circulate as meme coins.

*Smart contract: An automated contract execution system based on predefined rules.

*Meme coin: A cryptocurrency created as a joke with no practical use.

BRC-20 tokens have issuers who often hold large amounts of tokens initially, leading to pump-and-dump schemes (artificial price inflation followed by a crash). These tokens are highly speculative and can become worthless, so caution is needed.

I've seen posts on social media and YouTube saying "BRC-20 is hot! This token is recommended!" but…

Buying BRC-20 tokens on a whim could lead to buying at a peak and getting caught in a crash…

It's not just BRC-20, but altcoins in general see a surge in profit reports on social media during bubbles, making people think it's easy money.

But often, the social media hype marks the peak, followed by a decline.

Airdrop Risks

Airdrops are events where tokens or NFTs are distributed to people who meet certain conditions.

Participating in airdrops incurs effort and costs, and the distributed tokens may have little to no value. Some projects use airdrops to inflate prices and then sell off, while others aim to steal assets or information, so caution is needed.

Airdrops have traditionally been conducted on blockchains other than Bitcoin, but recently, projects using Bitcoin sidechains and Ordinals technologies have increased.

*Sidechain: A technology that processes transactions on a blockchain separate from the main chain.

It seems like many scammy projects are thinking, "If we ride the Bitcoin trend, it's easier to attract users."

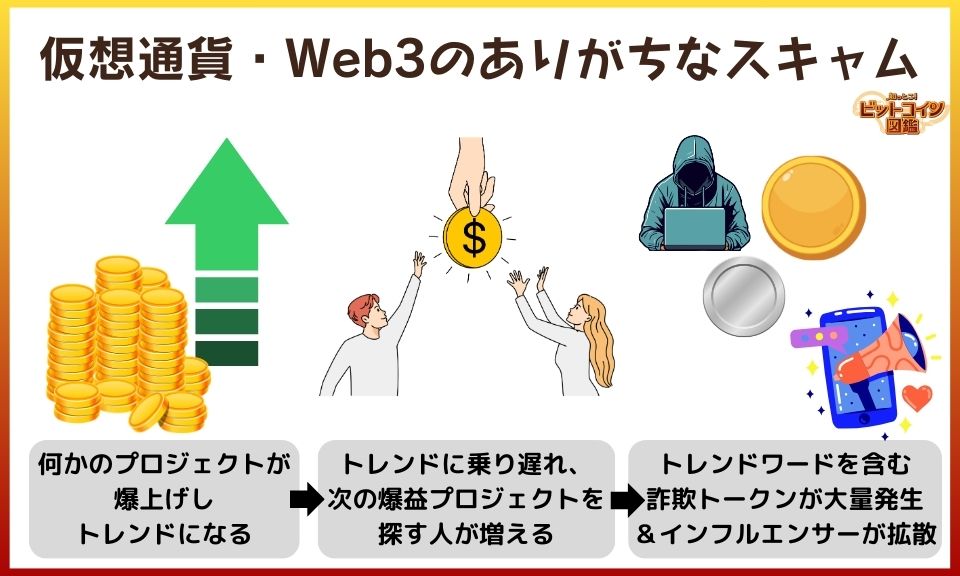

Caution: Chasing trending tokens is risky

A common mistake in cryptocurrency investing is impulsively buying tokens that seem promising after seeing reports of huge profits on social media.

When a project becomes highly popular, similar projects often appear rapidly, using marketing tactics to attract investors. Many scam projects target those who missed out on the initial boom and are looking for the next big thing, using various strategies to siphon funds from users.

Recently, there have been projects using trending words like "Bitcoin Layer 2," "BRC-20," "Ordinals NFT," and offering airdrops to attract users. Even if these projects include the name "Bitcoin," it's crucial to stay vigilant.

I often see Web3 influencers promoting "Promising Airdrop" They have a lot of followers, so it makes me curious…

Web3 influencers who promote specific airdrops or projects usually receive direct compensation from the project creators or earn affiliate commissions through referral links. Just because an influencer is promoting it doesn’t mean it's safe.

I’ve seen influencers who act like victims, claiming, "I also suffered great losses…" after a scam project is exposed!

I’ve seen influencers who act like victims, claiming, "I also suffered great losses…" after a scam project is exposed!

"Don’t invest money based on social media influencers' posts."

"Don’t panic buy into another token just because you missed out on a popular one."

These are crucial points to remember to protect your assets from disappearing quickly.

Risks of Cryptocurrency Exchanges and Lending Services

Are services operated by Japanese companies safe?

Centralized services run by companies concentrate data and assets in one place, making them more attractive targets for attackers. There are security concerns and bankruptcy risks, so you shouldn't trust them unconditionally.

Cryptocurrency Exchanges

| Exchange | Amount of Damage (Rate at the Time) | Year of Occurrence |

|---|---|---|

| Mt.GOX | 47 billion yen | February 2014 |

| Coincheck | 58 billion yen | January 2018 |

| Zaif | 6.7 billion yen | September 2018 |

| BITPOINT | 3.5 billion yen | July 2019 |

| Liquid | 6.9 billion yen | August 2021 |

| DMM Bitcoin | 48.2 billion yen | May 2024 |

Cryptocurrency exchanges are frequent targets for hackers, with several domestic exchanges suffering from hacks in the past.

A significant amount of cryptocurrency was stolen, and users were unable to access their assets.

(Reference) Examples of Asset Leakage in Other Financial Services

- Seven Bank - Mass withdrawal using counterfeit credit cards (Approx. ¥1.4 billion / 2016)

- Docomo Account - Identity theft (¥18 million from 66 accounts / 2020)

Most asset leakage incidents in traditional financial institutions involve individual accounts, unlike the massive outflows seen in cryptocurrency exchanges.

In the Mt. Gox case, refunds to users are still ongoing, but I heard funds were reimbursed in other domestic exchange hack cases. Doesn’t that make it safer if compensation is guaranteed?

There’s no guarantee that hacked exchanges will always provide compensation. Around 2017-2018, exchanges might have had high profits due to high trading volumes, but data up to 2023 shows a significant decline in trading volumes.

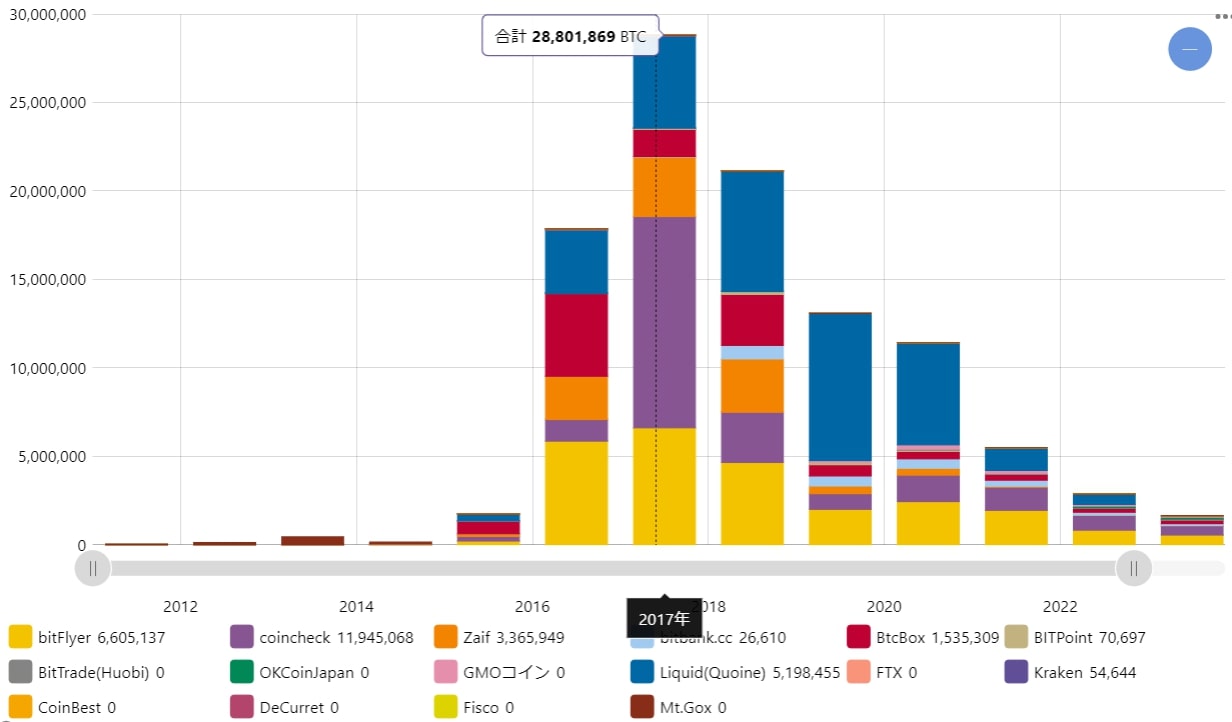

Annual Bitcoin Trading Volume from 2011 to 2023

The low trading volume in 2023 is surprising! Why did the trading volume drop so much?

In 2018, interest in various altcoins surged, increasing the demand for exchanging Bitcoin for altcoins. Later, users might have shifted to DeFi or overseas exchanges.

The environment surrounding domestic exchanges is changing. If an unstable exchange gets hacked, it could go bankrupt…

Lending Services

Lending involves lending out cryptocurrencies to receive interest in return. Lending is not subject to segregated management or deposit insurance schemes, meaning there is a risk that users' assets may not be protected.

Segregated management: Managing users' assets separately from the exchange's assets.

Deposit insurance scheme: An insurance system to protect users' deposits if a financial institution goes bankrupt.

Be particularly cautious with lending services that promise high returns. There is a possibility that the funds collected from users are being used for high-risk transactions (such as highly leveraged trades), or that the platform operates a Ponzi scheme, which is inherently unsustainable.

Failed Lending Platforms

- Bitconnect

Promised high returns but suddenly shut down in 2018. It's considered one of the biggest scams in cryptocurrency history. - BlockFi, Celsius Network, Genesis

Affected by the collapse of Terra & UST and the bankruptcy of FTX, leading to a chain reaction of lending platform failures. - FTX

A global cryptocurrency exchange that also offered high-yield lending through "FTX Earn." It went bankrupt in November 2022, significantly impacting the crypto market.

I've heard opinions that "Lending has high risks despite low returns."

Don't let the convenience and high returns blind you. I don't recommend putting your assets at risk so easily.

Summary: Risks of Bitcoin Investment

Key Points

- Common risks of Bitcoin include price crashes and hacking.

- Be cautious of Web3 projects claiming to be Bitcoin-related tokens or "Layer 2" solutions aimed at raising funds.

- Many scam projects target those looking for the next big token after missing out on popular ones.

Recently, there’s been a lot of promotion for Bitcoin-related tokens and NFT airdrops… Even if an influencer’s post gets retweeted a lot, it doesn’t mean it’s safe.

Even if many projects claim you can "bridge & earn massive returns with Bitcoin & airdrops," remember that there are significant risks involved.

I was kind of nervous about bitcoin because it sounds kind of difficult and I don't really know what it is, but I wanted to know more about it.

I want to know more about bitcoin!

Recommended Articles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.