I've heard that the spreads for buying bitcoin can be quite wide. Can you show me a comparison of different cryptocurrency exchanges?

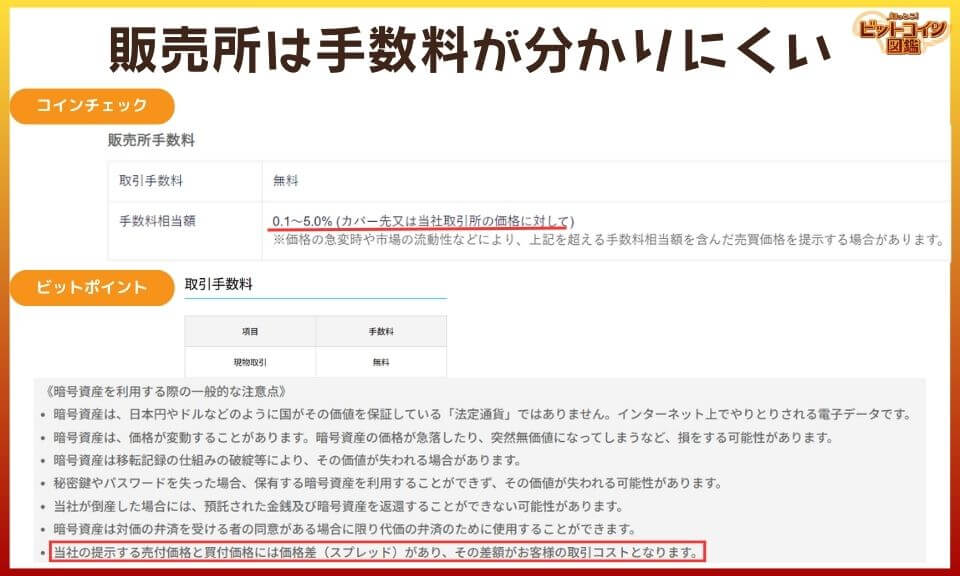

When buying bitcoin on a cryptocurrency exchange, there is often an "invisible fee" known as the "spread."

Many cryptocurrency exchanges state that they have "no transaction fees," but in reality, the spread can end up costing you more.

In this article, I'll provide a detailed comparison of the spreads at 11 Japanese cryptocurrency exchanges.

This article was written in Japanese and converted to English using a translation tool.

Date of writing (Japanese version): December 2023

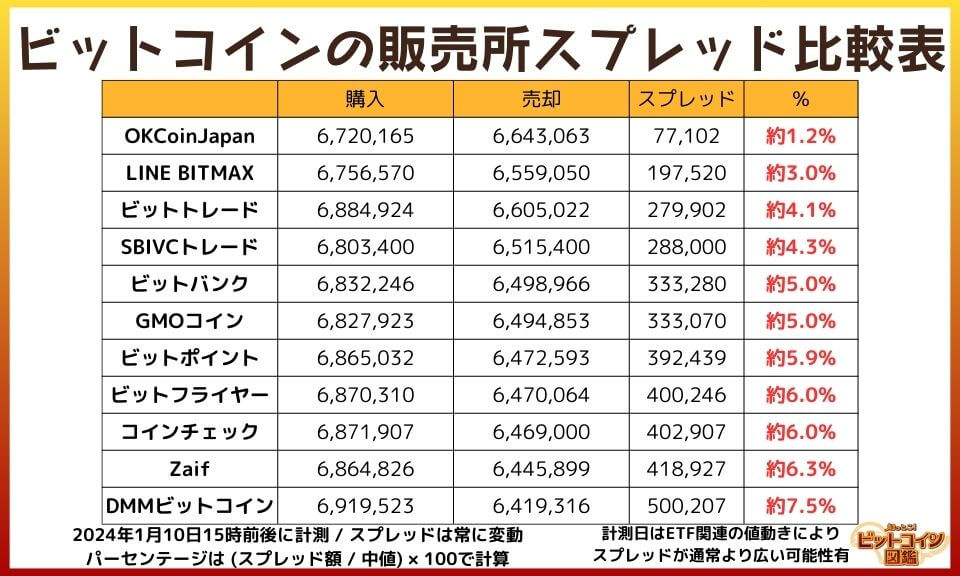

Comparison of Bitcoin Spreads at Japanese Cryptocurrency Exchanges

Among the 11 cryptocurrency exchanges compared, OKCoinJapan had the narrowest spread as of the November 2023 survey.

For example, if you buy 100,000 yen worth of bitcoin and sell it immediately, a 1% spread would cost you 1,000 yen, whereas a 5.9% spread would cost you 5,900 yen.

The description says there are "no bitcoin transaction fees," but the spread actually costs quite a bit!

Compared to stocks, forex, and other investments, the spreads on cryptocurrency exchanges are significantly wider.

Measured in January 2024, spread of the sales exchange format

Spreads in the form of sales offices, measured in April 2024

When you measure on different days, some exchanges have consistent spreads, while others show significant variation.

Remember that spreads can change dramatically even within a single day.

Spreads in Exchange Format (Reference)

Data collected around 2:00 PM on February 7, 2024. Spreads fluctuate constantly.

The exchange format has a very narrow spread!

There's a significant difference in the spread between the sales exchange format and the exchange format.

To buy bitcoins at a lower cost, consider using the exchange format.

What is a Bitcoin Spread?

I'm not really sure what a Bitcoin spread is.

I've heard that virtual currency spreads are often very high…

The spread is the difference between the buying and selling prices.

In simple terms, it's like a hidden fee.

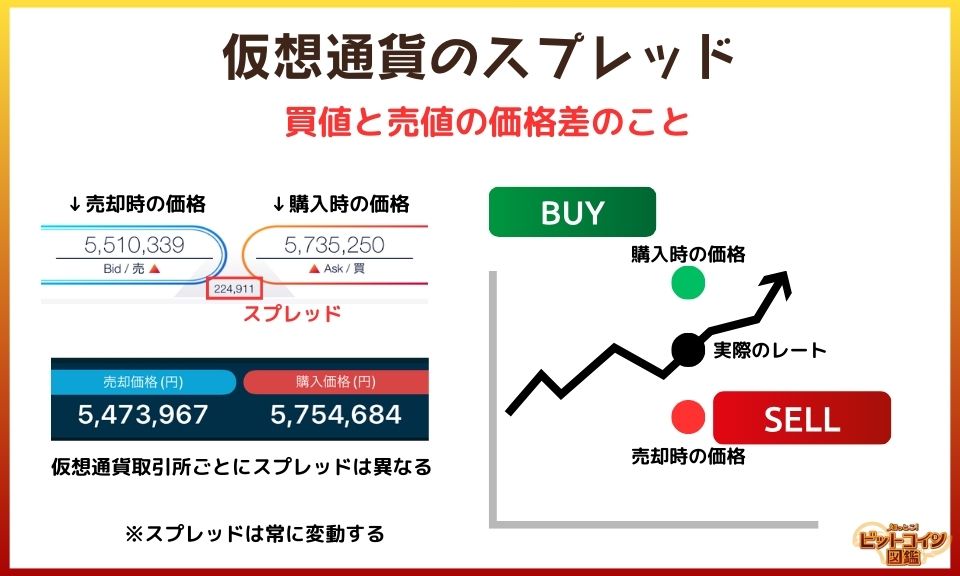

Virtual Currency Spread

The spread is the "difference between the bid and offer prices," a term used not only for Bitcoin but also for stocks, forex, and other types of trading.

The spread indicates the cost of trading; the narrower the spread, the lower the transaction cost.

Spreads tend to be narrower in highly liquid (actively traded) markets, and Bitcoin spreads are generally narrower compared to other virtual currencies.

Keep in mind that spreads tend to widen during sudden market price fluctuations, which can increase your cost burden.

So, the spread isn't fixed and is always fluctuating.

For virtual currencies, the spread at "sales exchanges" is particularly wide.

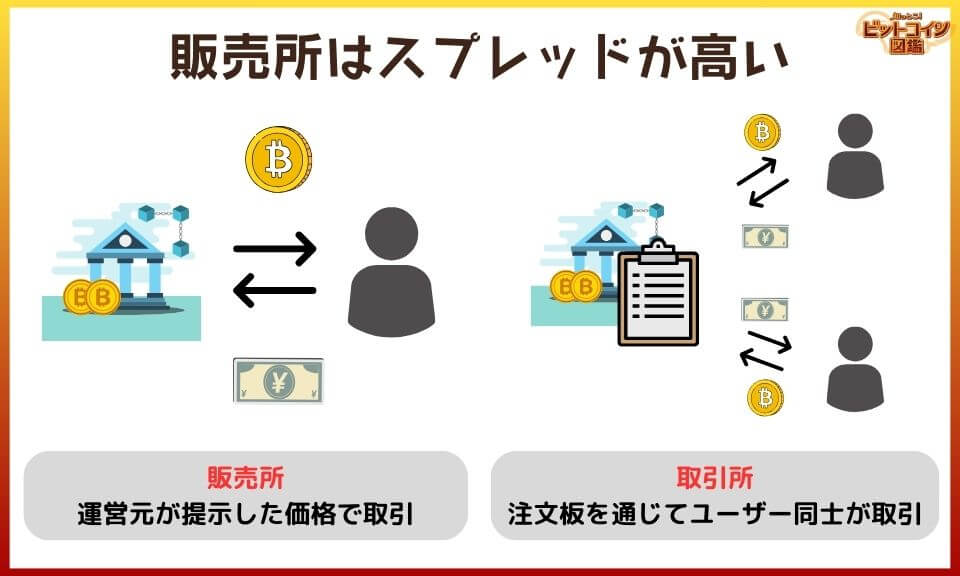

Sales Exchanges Have Higher Spreads

There are two types of virtual currency exchanges: "sales exchanges" and "exchange formats." Sales exchanges have particularly wide spreads.

At a sales exchange, the operator sets the buying and selling prices, and the difference (spread) is effectively their commission.

If you want to save money, it is recommended to use an exchange format where users set their desired prices to each other.

So, the spread at a sales exchange is like a hidden fee… Are there any benefits to using a sales exchange despite the wider spread?

Sales exchanges offer advantages such as ease of use for beginners and instant transaction execution, making them suitable for those nervous about buying virtual currency.

However, there is a similar system overseas, but the spread is much smaller than in Japan…

I wish Japanese virtual currency exchanges had tighter spreads at their sales exchanges.

Fees for Sales Exchanges and Exchange Formats

The fee structure of virtual currency exchanges can be complex. In addition to visible transaction fees, there's often a hidden fee called the "spread."

At first glance, it may seem that sales exchanges are more economical since they often advertise "no transaction fees," while exchange formats have set transaction fees.

In reality, however, sales exchanges have wider spreads set by the operator, making exchange formats more cost-effective.

Sales Exchange Spread vs. Exchange Trading Fees

- Sales exchange spread:

→ Typically set between 2% and 10%.

→ Buying and selling 10,000 yen worth of virtual currency can cost you about 200 to 1,000 yen. - Exchange transaction fees:

→ Typically set between 0.01% and 0.1%.

→ Buying or selling 10,000 yen worth of virtual currency costs about 1 to 15 yen.

At a sales exchange, if you buy 10,000 yen worth of virtual currency and sell it, you could be charged as much as 1,000 yen!

The moment you buy, you're starting from a big negative.

To keep costs down, it's better to use an exchange format instead of a sales exchange.

If you're unsure, try using an exchange format for a small amount to get used to trading.

Bitcoin Spreads on Virtual Currency Exchanges

What is the spread of bitcoin on each of the virtual currency exchanges and on the sales floor?

I'll show you the order of the tightest bitcoin sales exchange spreads, based on the data I looked up around 8pm on November 13, 2023.

Spreads change on a daily and second-by-second basis, so please use them only as a reference.

I also looked at virtual currencies other than Bitcoin, such as Ethereum and XRP, as well as other virtual currencies that are not widely handled on other exchanges (i.e., those where spreads are expected to be wide).

OKCoinJapan Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,147,951 | 9,807,616 | 340,335 | 約3.4% |

| ETH | 509,967 | 492,400 | 17,567 | 約3.5% |

| XRP | 89.630 | 83.800 | 5.830 | 約6.7% |

| OKB | 8,792.4 | 8,217.3 | 575.1 | 約6.8% |

| ARB | 231.77 | 212.31 | 19.46 | 約8.8% |

| Buy | Sell | Spread | % | |

| BTC | 6,720,165 | 6,643,063 | 77,102 | 約1.2% |

| ETH | 349,703 | 345,298 | 4,405 | 約1.3% |

| XRP | 84.690 | 80.680 | 4.010 | 約4.8% |

| OKB | 8,051.4 | 7,666.8 | 384.6 | 約4.9% |

| ARB | 293.14 | 274.57 | 18.57 | 約6.5% |

It's an exchange that was launched in Japan in 2020 by the OK Group of OKX, an overseas exchange.

The spread is wider overall when I measured it in April than it was in January 2024.

It could change from day to day, and I should probably measure it again.

LINE BITMAX Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,080,839 | 9,797,192 | 283,647 | 約2.9% |

| ETH | 513,778 | 485,196 | 28,582 | 約5.7% |

| XRP | 91.240 | 81.580 | 9.660 | 約11.2% |

| FNSA | 5,174.17 | 4,617.37 | 556.80 | 約11.4% |

| XLM | 19.62 | 18.67 | 0.95 | 約5.0% |

| Buy | Sell | Spread | % | |

| BTC | 6,756,570 | 6,559,050 | 197,520 | 約3.0% |

| ETH | 355,691 | 335,741 | 19,950 | 約5.8% |

| XRP | 87.090 | 77.730 | 9.360 | 約11.4% |

| FNSA | 4,119.31 | 3,668.22 | 451.09 | 約11.6% |

| XLM | 17.24 | 16.40 | 0.84 | 約5.0% |

It's LINE's virtual currency exchange.

It's mainly a sales exchange, but recently FNSA (Finsia) can be bought in exchange format.

So FNSA is a virtual currency used in the blockchain that LINE is involved in developing.

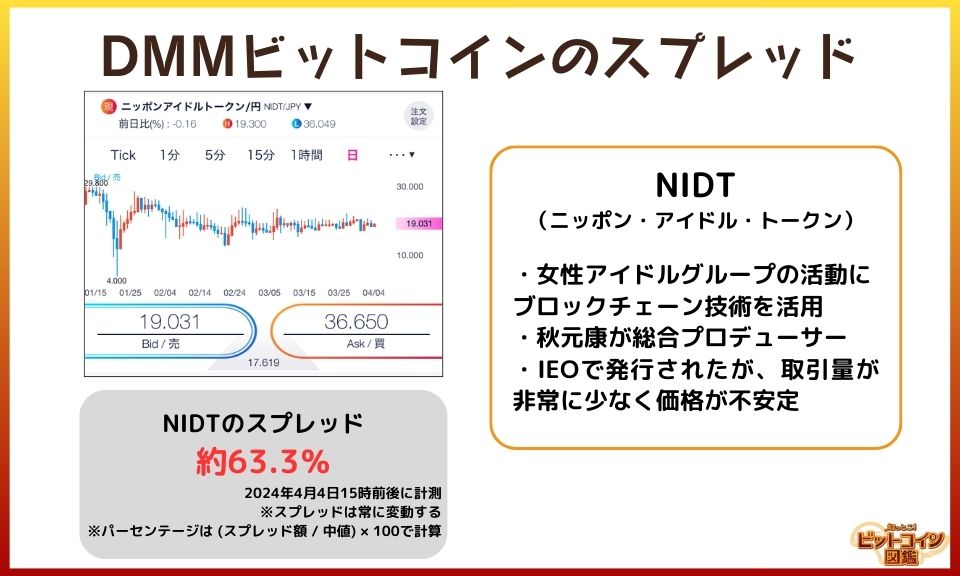

DMM Bitcoin Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,164,580 | 9,717,239 | 447,341 | 約4.5% |

| ETH | 512,077 | 487,094 | 24,983 | 約5.0% |

| XRP | 88.618 | 84.297 | 4.321 | 約5.0% |

| ZPG | 11,443.38 | 10,994.62 | 448.76 | 約4.0% |

| NIDT | 36.650 | 19.031 | 17.619 | 約63.3% |

| Buy | Sell | Spread | % | |

| BTC | 6,919,523 | 6,419,316 | 500,207 | 約7.5% |

| ETH | 359,250 | 333,275 | 25,975 | 約7.5% |

| XRP | 86.867 | 78.220 | 8.647 | 約10.5% |

| ZPG | 9,622.68 | 9,245.32 | 377.36 | 約4.0% |

| NIDT | 56.450 | 25.300 | 31.150 | 約76.2% |

When measured in November, the bitcoin spread was about 4.0%, so it likely varies from day to day.

DMM Bitcoin does not offer an exchange format, so DMM Bitcoin may cater to those looking for an easy way to purchase virtual currency.

The spread of NIDT, a virtual currency, is too high! I'm a little surprised.

SBIVC Trade Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,120,050 | 9,735,750 | 384,300 | 約3.9% |

| ETH | 509,895 | 487,035 | 22,860 | 約4.6% |

| XRP | 88.336 | 84.391 | 3.945 | 約4.6% |

| ATOM | 1,707.826 | 1,574.597 | 133.229 | 約8.1% |

| XDC | 7.398 | 6.372 | 1.026 | 約15.0% |

| Buy | Sell | Spread | % | |

| BTC | 6,803,400 | 6,515,400 | 288,000 | 約4.3% |

| ETH | 352,940 | 338,500 | 14,440 | 約4.1% |

| XRP | 84.538 | 79.938 | 4.600 | 約5.6% |

| ATOM | 1,480.082 | 1,360.649 | 119.433 | 約8.4% |

| XDC | 7.618 | 6.827 | 0.791 | 約11.0% |

SBIVC Trade is an exchange that primarily focuses on altcoin staking.

Be aware that more than half of the cryptocurrencies it handles can only be traded on the sale exchange.

I see that XDC is a virtual currency that is rarely handled by domestic exchanges.

Bitbank spreads.

| Buy | Sell | Spread | % | |

| BTC | 10,216,348 | 9,717,989 | 498,359 | 約5.0% |

| Buy | Sell | Spread | % | |

| BTC | 6,832,246 | 6,498,966 | 333,280 | 約5.0% |

| ETH | 354,384 | 337,070 | 17,314 | 約5.0% |

| XRP | 84.416 | 80.297 | 4.119 | 約5.0% |

| RNDR | 593.160 | 544.616 | 48.544 | 約8.5% |

| BNB | 45,500 | 41,892 | 3,608 | 約8.3% |

It's a virtual currency exchange where all cryptocurrencies are available on both the sales and exchange formats.

It seems that Bitbank's sales exchange spread can only be confirmed if you have the corresponding coins.

Minami, the author, abandoned the research saying, "I'm tired of buying small amounts of altcoins every time and selling them right away to research the spread." Please forgive me.

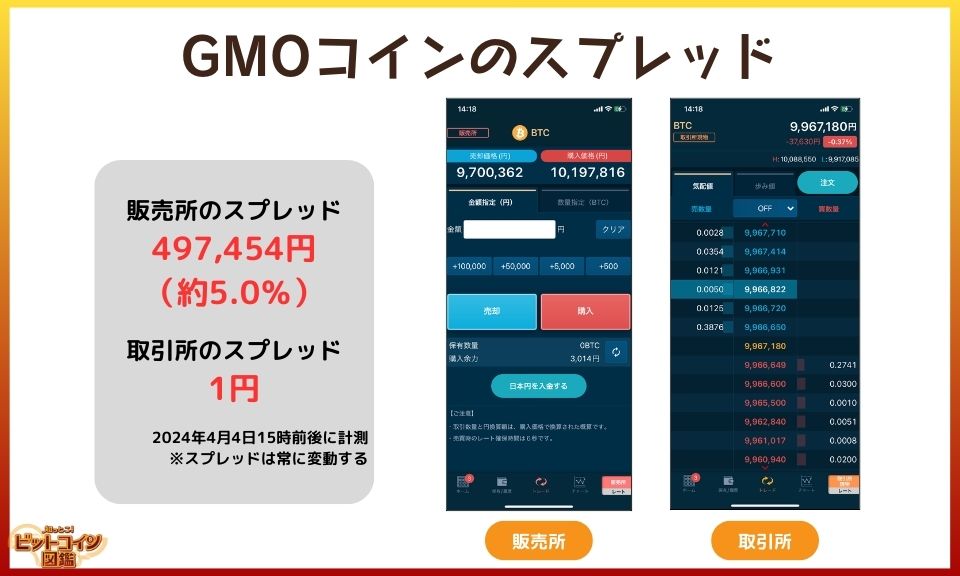

GMO Coin Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,197,816 | 9,700,362 | 497,454 | 約5.0% |

| ETH | 512,354 | 487,361 | 24,993 | 約5.0% |

| XRP | 88.611 | 84.288 | 4.323 | 約5.0% |

| SOL | 29,023 | 26,259 | 2,764 | 約10.0% |

| FIL | 1,329.778 | 1,203.132 | 126.646 | 約10.0% |

| Buy | Sell | Spread | % | |

| BTC | 6,827,923 | 6,494,853 | 333,070 | 約5.0% |

| ETH | 354,368 | 337,082 | 17,286 | 約5.0% |

| XRP | 84.349 | 80.234 | 4.115 | 約5.0% |

| SOL | 15,453 | 13,297 | 2,156 | 約15.0% |

| FIL | 838.855 | 774.327 | 64.528 | 約8.0% |

It's a virtual currency exchange where many cryptocurrencies can be bought and sold on both the sales and trading platforms.

Altcoins typically have very wide spreads, so it's better to use a trading platform whenever possible.

BitTrade Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,240,210 | 9,733,737 | 506,473 | 約5.1% |

| ETH | 522,017 | 488,981 | 33,036 | 約6.5% |

| XRP | 90.00 | 85.46 | 4.54 | 約5.2% |

| HT | 133.128 | 106.888 | 26.240 | 約21.9% |

| BSV | 15,951.06 | 11,736.75 | 4,214.31 | 約30.4% |

| Buy | Sell | Spread | % | |

| BTC | 6,884,924 | 6,605,022 | 279,902 | 約4.1% |

| ETH | 357,208 | 341,643 | 15,565 | 約4.5% |

| XRP | 84.30 | 81.07 | 3.23 | 約3.9% |

| HT | 384.507 | 320.960 | 63.547 | 約18.0% |

| BSV | 14,880.03 | 12,007.19 | 2,872.84 | 約21.3% |

BitTrade is a Japanese virtual currency exchange operated by the Huobi Group, an overseas exchange. It was formerly known as Huobi Japan.

The spread on altcoins seems to be pretty wide, but it offers cryptocurrencies that are not available on other exchanges.

Bitpoint spreads

| Buy | Sell | Spread | % | |

| BTC | 10,202,164 | 9,728,966 | 473,198 | 約4.7% |

| ETH | 516,994 | 481,498 | 35,496 | 約7.1% |

| XRP | 90.518 | 82.625 | 7.893 | 約9.1% |

| SHIB | 0.0042125 | 0.0037927 | 0.0004198 | 約10.5% |

| TSUGT | 5.4774 | 4.7022 | 0.7752 | 約15.2% |

| Buy | Sell | Spread | % | |

| BTC | 6,865,032 | 6,472,593 | 392,439 | 約5.9% |

| ETH | 357,960 | 333,229 | 24,731 | 約7.2% |

| XRP | 85.978 | 78.467 | 7.511 | 約9.1% |

| SHIB | 0.0014604 | 0.0013143 | 0.0001461 | 約10.5% |

| TSUGT | 7.8701 | 6.8045 | 1.0656 | 約14.5% |

At 3pm on January 1, 2024, the spread was about 5.9%, but by 5pm the same day, it had decreased to about 4.7%.

Spreads can vary significantly throughout the day.

Bitpoint was the first exchange in Japan to handle various virtual currencies such as ADA (Cardano/Adacoin), TRX (TRON), and JASMY (JASMY).

The smartphone app is limited to sales exchanges, so those who want to minimize costs may prefer to use the browser version.

BitFlyer Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,253,970 | 9,656,075 | 597,895 | 約6.0% |

| ETH | 517,824 | 482,738 | 35,086 | 約7.0% |

| XRP | 91.00 | 82.33 | 8.67 | 約10.0% |

| SHIB | 0.0041736 | 0.0037760 | 0.0003976 | 約10.0% |

| ZPG | 11,327.06 | 11,089.44 | 237.62 | 約2.1% |

| Buy | Sell | Spread | % | |

| BTC | 6,870,310 | 6,470,064 | 400,246 | 約6.0% |

| ETH | 357,749 | 333,553 | 24,196 | 約7.0% |

| XRP | 86.10 | 77.89 | 8.21 | 約10.0% |

| SHIB | 0.0014515 | 0.0013131 | 0.0001384 | 約10.0% |

| ZPG | 9,530.47 | 9,330.53 | 199.94 | 約2.1% |

It's the largest virtual currency exchange in Japan by bitcoin trading volume.

I prefer to buy bitcoins in exchange format because of the wide spreads at sales exchanges.

The types of cryptocurrencies you can buy through the exchanges are limited, but you can buy bitcoin through the exchanges even from the app.

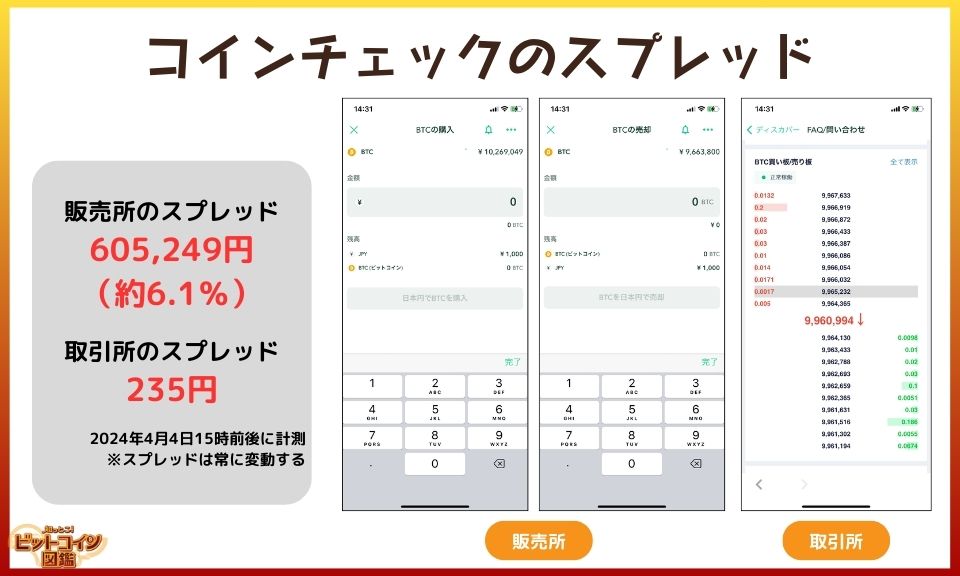

Coincheck spreads

| Buy | Sell | Spread | % | |

| BTC | 10,269,049 | 9,663,800 | 605,249 | 約6.1% |

| ETH | 518,279 | 482,690 | 35,589 | 約7.1% |

| XRP | 90.643 | 82.770 | 7.873 | 約9.1% |

| FNCT | 0.7066 | 0.6156 | 0.0910 | 約13.8% |

| IOST | 1.78 | 1.51 | 0.27 | 約16.1% |

| Buy | Sell | Spread | % | |

| BTC | 6,871,907 | 6,469,000 | 402,907 | 約6.0% |

| ETH | 357,961 | 333,430 | 24,531 | 約7.1% |

| XRP | 85.823 | 78.310 | 7.513 | 約9.2% |

| WBTC | 6,996,921 | 6,324,400 | 672,521 | 約10.0% |

| IOST | 1.40 | 1.20 | 0.20 | 約15.2% |

The spreads are wide, but they feature no transaction fees for bitcoin on the exchange.

I see that the mobile app is mainly for sales exchanges, and the exchange option is less prominent in the app.

I'd like to see the exchange option placed in a more obvious place.

Zaif Spreads

| Buy | Sell | Spread | % | |

| BTC | 10,414,898 | 9,573,359 | 841,539 | 約8.4% |

| ETH | 521,516 | 479,993 | 41,523 | 約8.3% |

| MV | 6.667 | 5.730 | 0.937 | 約15.1% |

| COT | 6.679 | 5.911 | 0.768 | 約12.2% |

| MBX | 207.8380 | 154.0760 | 53.7620 | 約29.7% |

| Buy | Sell | Spread | % | |

| BTC | 6,864,826 | 6,445,899 | 418,927 | 約6.3% |

| ETH | 360,075 | 329,303 | 30,772 | 約8.9% |

| MV | 6.065 | 4.756 | 1.309 | 約24.2% |

| COT | 4.958 | 4.107 | 0.851 | 約18.8% |

| MBX | 112.7340 | 83.4680 | 29.2660 | 約29.8% |

It's a virtual currency exchange well known among long-time users.

The spread is wide, but all cryptocurrencies can be traded in an exchange format.

It looks like you should use an exchange as much as possible, because the altcoin dealer spreads are surprisingly wide.

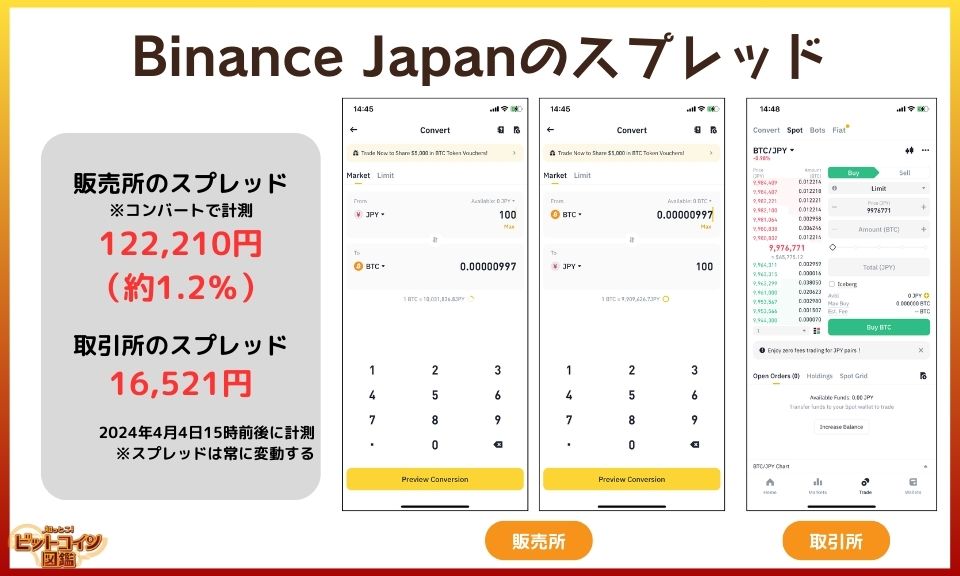

Binance Japan Spreads

| Binance | Buy | Sell | Spread | % |

| BTC | 10,031,836.8 | 9,909,626.7 | 122,210.1 | 約1.2% |

| ETH | 502,877.1 | 499,690.7 | 3,186.4 | 約0.6% |

| XRP | 87.6785 | 85.8878 | 1.7907 | 約2.1% |

| BNB | 88,654.7 | 87,116.7 | 1,538.0 | 約1.8% |

| SUI | 260.445 | 255.079 | 5.366 | 約2.1% |

It's a platform that Binance, an overseas exchange, launched in Japan in 2023.

They started trading BTC, ETH, and BNB in Japanese yen on their platform in March 2024.

It appears that Binance Convert has a narrower spread than other exchanges.

Why DMM Bitcoin spreads are considered terrible.

As of November 13, 2023, the spread on the Nippon Idol Token (NIDT) handled by DMM Bitcoin is over 50%.

If you buy NIDT for 100,000 yen and sell it immediately, you would incur a loss of 50,000 yen.

Additionally, when the spread is calculated as (spread amount / mid-price) x 100, it exceeded 70% on January 10, 2023, and remained over 60% as of April 4, 2023.

NIDT is a virtual currency issued through an IEO* by two companies, DMM Bitcoin and coinbook. Currently, the trading volume is very low and the price is unstable.

*IEO…a method of fundraising by virtual currency projects through an exchange.

現在の価格提示の理由につきましては、当社のカバー先であるcoinbook社の取引所において、取引参加者が非常に限定的で、かつ、最良気配の価格付近の注文が非常に少ない状況であることから、少ない取引量で大きな価格変動を起こす可能性のある危険な状態となっていることが確認されているためです。

また、coinbook社の取引所における流動性の低下や、当社の販売所における売買実績等を含め、需給状態の全体像を総合的に勘案した価格配信を実施しております。

この度の状況を踏まえて、過度な価格変動を未然に防止することへの対応をcoinbook社には引き続き要請しております。

出典:DMM Bitcoin

I searched for「NIDT スプレッド」on Twitter and found that the spread has been wide since April, when it was first listed.

When NIDT experienced significant price fluctuations in September, some people said they couldn't take profits because the spread was too wide.

DMM Bitcoin has a relatively narrow bitcoin spread on their sales exchange, but the NIDT spread is too wide.

I hope they address this issue soon.

During the re-survey on June 24, 2024, NIDT's bid price was 8.9 yen and the offer price was 8.4 yen, reducing the spread to about 6.3%.

The Spreads Reveal the Dark Side of Virtual Currency Exchanges.

I wonder if the operators of virtual currency exchanges encourage us to buy virtual currency on the sales exchange to profit from the spread…

Here are some insights on spreads from virtual currency exchanges.

High minimum purchase amounts for the exchange format.

Minimum BTC purchase amount

| sales exchange | Trading exchange | |

|---|---|---|

| SBIVCトレード | 0.0001BTC | 0.000001BTC |

| BitTrade | 0.0001BTC | 0.000001BTCかつ2円 |

| GMOコイン | 0.00001BTC | 0.0001BTC |

| ビットバンク | 0.00000001BTC | 0.0001BTC |

| ビットポイント | 0.00000001BTC | 0.0001BTC |

| OKCoinJapan | 0.0001BTC | 0.0001BTC |

| ビットフライヤー | 0.00000001BTC | 0.001BTC |

| Zaif | 0.0001BTC | 0.001BTC |

| コインチェック | 約500円 | 0.005BTC以上 かつ500円以上 |

| LINE BITMAX | 約1円 | BTC:なし |

| DMMビットコイン | 0.0001BTC | 取引所形式なし |

There are cryptocurrency exchanges that advertise that "You can buy Bitcoin from 500 yen!" or "You can buy Bitcoin from 1 yen!"

However, in most cases the minimum purchase amount differs between the sales office and the exchange.

For example, at Coincheck's sales exchange, you can buy bitcoins for as little as 500 yen, but on the exchange you can only buy bitcoins from 0.005 BTC*.

*At the rate of December 20, 2023, the price is approximately 30,000 yen.

Depending on the exchange, there are cases where the minimum purchase amount on the sales exchange and the exchange differs greatly, so be careful.

Depending on the exchange, there are cases where the minimum purchase amount on the sales exchange and the exchange differs greatly, so be careful.

Encourage the purchase of altcoins

Number of brands handled

| sales exchange | Trading exchange | |

|---|---|---|

| Binance Japan | 47* | 47* |

| Bitbank | 37 | 37 |

| OKCoinJapan | 30 | 34 |

| BitTrade | 37 | 28 |

| GMO Coin | 21 | 23 |

| Zaif | 17 | 22 |

| Bitpoint | 21 | 11 |

| Coincheck | 26 | 8 |

| SBIVC Trade | 20 | 7 |

| BitFlyer | 25 | 6 |

| LINE BITMAX | 7 | 1 |

| DMM Bitcoin | 38 | 0 |

| Mercoin | 1 | 0 |

*Only BTC, ETH, and BNB are supported for yen-denominated order book trading on Binance Japan.

The stock with the larger number of listings between the sales exchange and the regular exchange is displayed in red. If the number is the same for both, the regular exchange is displayed in red.

Some virtual currency exchanges have a large difference in the number of cryptocurrencies that can be bought in the sales exchange format and the exchange format.

Some exchanges offer wide spreads for virtual currencies other than Bitcoin (altcoins), and some exchange operators recommend purchasing altcoins on the sales exchange.

In particular, be wary of spreads for "altcoins that are rarely handled by other domestic exchanges," as they can be wide.

Even though the number of cryptocurrencies they handle may seem large at first glance, some exchanges state that most of them can only be traded on a sales exchange.

It seems that using exchanges is common overseas, and I hope the same trend will happen in Japan.

Maybe they are trying to make it easier to understand for beginners, but it would be nice if both sales exchanges and regular exchanges are enhanced.

A Question and Answer on Bitcoin Spreads

I wish I knew a lot more about bitcoin spreads.

I'll answer your questions about bitcoin spreads in a question-and-answer format.

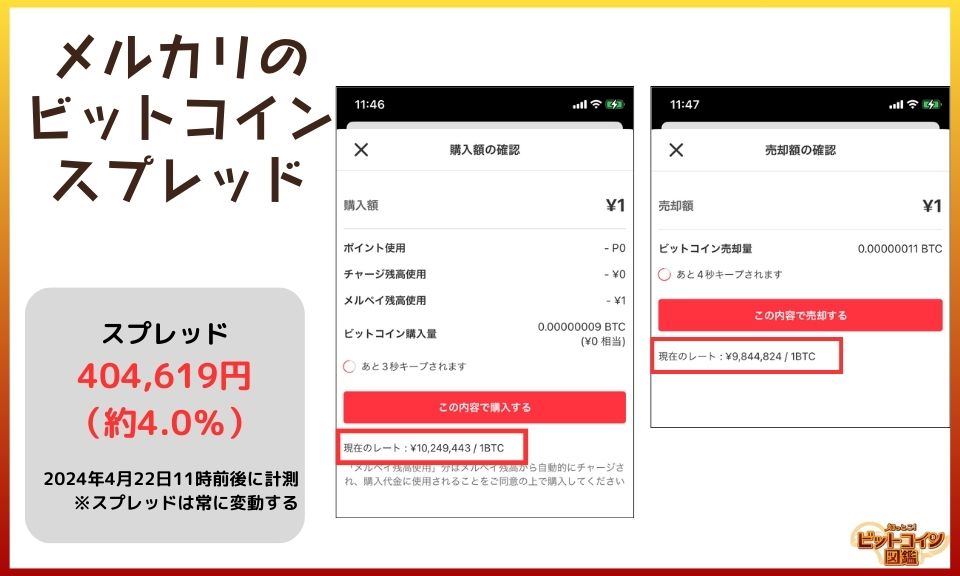

Is there a spread on Mercari's bitcoin service?

Yes, there is a spread for Mercari's bitcoin trading service.

There is no registration fee or trading fee, but the spread is included in the bitcoin trading price, which means that a substantial fee is charged.

Mercari's bitcoin transactions incur a spread of approximately 1% on purchases and 1% on sales, for a total spread of approximately 2%.

I did a Twitter search for「メルカリ ビットコイン スプレッド」and saw people saying it’s around 2% for buying and selling combined.

When the author (Minami) checked in April 2024, it was around 4%.

From the point of view of someone who invests in stocks, etc., a 2% spread might seem high.

However, Mercari's bitcoin spread is narrower than that of many other virtual currency exchanges.

How do bitcoin spreads compare to international exchanges?

Survey conducted in November 2023

Compared to Japanese exchanges, spreads tend to be narrower on overseas exchanges with higher trading volumes.

Overseas exchanges vary in size, but in general, exchanges with larger trading volumes have narrower spreads.

However, in Japan, regulations on foreign exchanges are being tightened, and various foreign exchanges, such as the global version of Binance, can no longer be used freely.

When using an exchange, choose a service that takes into account not only the spread, but also security, regulation, and bankruptcy risk.

Sites where you can compare trading volume and spreads in real-time

I see that some exchanges have low trading volume, which makes it difficult to close trades.

Bitcoin is easier to trade than other altcoins, but some exchanges have lower liquidity overall.

When choosing an exchange, you should also check to see if there is active trading.

[Summary] Bitcoin Spre

Key Points

- There are two types of virtual currency exchanges: sales exchanges and trading exchanges, and sales exchanges have very wide spreads.

- Avoid sales exchanges when buying and selling bitcoin.

- Beware of virtual currency exchanges that have very wide sales exchange spreads.

Many exchanges say "No Bitcoin transaction fees!" but in reality, they charge a spread.

If I had bought bitcoin without knowing anything about it, I would have lost money without realizing it.

For those who have never invested in virtual currency before, it's hard to understand the spread.

Try to understand the differences before choosing whether to use the easy-to-buy sales format or the exchange format, which allows you to avoid wide spreads.

I felt like Bitcoin was kind of difficult to understand, but I wish I knew a lot of other things about it.

I want to know more about bitcoin!

Recommended Articles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.