Bitcoin ETFs have been approved, but does that mean we can't buy them in Japan?

Although the Bitcoin ETF that had been attracting attention since around 2023 has finally been approved, at present, Bitcoin ETFs cannot be purchased in Japan. The Japan Cryptocurrency Business Association (JCBA) has begun organizing the feasibility, including legal regulations, of cryptocurrency spot ETFs, and progress is awaited in various quarters.

In this article, I'll introduce information related to Bitcoin ETFs and price charts from when Bitcoin futures and spot ETFs were approved in the past.

This article was written in Japanese and converted to English using a translation tool.Date of writing (Japanese version): January 2024

Will the Day Come When Bitcoin ETFs Can Be Bought in Japan?

【新着情報更新】暗号資産などの非特定資産等を投資対象とする投資信託等の組成・販売が適当ではないこと等について追記した「金融商品取引業者等向けの総合的な監督指針」の一部改正(案)について公表しました。(パブコメ募集中)https://t.co/t1vIKOO9jM

— 金融庁 (@fsa_JAPAN) September 30, 2019

The Financial Services Agency (FSA) released an opinion on cryptocurrency ETFs in 2019, and currently, it is difficult to form and sell Bitcoin ETFs in Japan.

FSA's Response to Public Comments (September 2019)

Regarding cryptocurrency ETFs, if the ETF itself is an investment trust, based on this supervisory guideline amendment, it will be difficult to form and sell it domestically. Additionally, forming and selling investment trusts that invest in overseas cryptocurrency ETFs is also considered to have the same nature as non-specified assets.

Source:コメントの概要及びコメントに対する金融庁の考え方|金融庁

The English translation is by the author.

For example, it is expected that financial products targeting cryptocurrencies will be formed in the future, but there are concerns that investment in cryptocurrencies may promote speculation, and the FSA believes that it should respond cautiously to forming and selling investment trusts that invest in such assets.

Source:「金融商品取引業者等向けの総合的な監督指針」の一部改正(案)の公表について|金融庁

The English translation is by the author.

Some people thought they could buy Bitcoin ETFs with the new NISA, but it's difficult at present…

*As of January 16, 2024

Furthermore, Tomohiko Kondo, President of SBI VC Trade and Head of the Financial Division of the JCBA, expressed the following view:

The JCBA's Financial Division has already begun organizing the feasibility, including legal regulations, of cryptocurrency spot ETFs domestically. There are various players involved in addressing the significant presence of Bitcoin ETFs, and we are organizing what possibilities can be considered and what legal and regulatory amendments are needed.

There are many issues to be sorted out regarding handling cryptocurrency ETFs in Japan. For instance, whether the Bitcoin ETFs approved overseas can be brought here or whether to form cryptocurrency ETFs domestically. Additionally, there are tax issues. ETFs are financial products and, for individuals, may be subject to separate taxation. On the other hand, transactions of spot cryptocurrencies are comprehensively taxed, and voices seeking consistency will naturally arise.

Source:CoinDesk

The English translation is by the author.

It would be great if the current laws are revised and the day comes when Bitcoin ETFs can be bought in Japan.

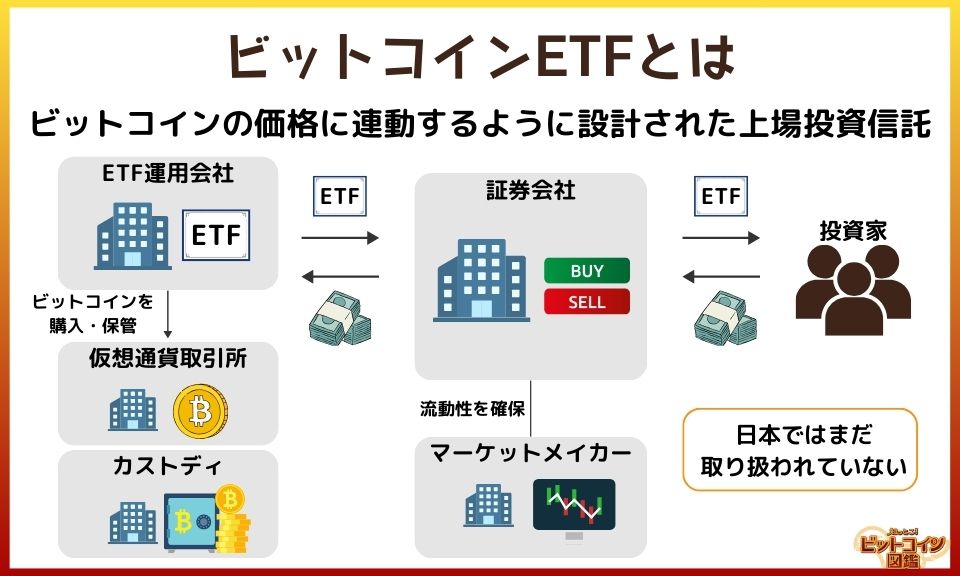

What is a Bitcoin ETF?

A Bitcoin ETF is an exchange-traded fund designed to track the price of Bitcoin. It allows investors to invest in the Bitcoin market without directly buying or storing Bitcoin.

Unlike Bitcoin, which is traded on cryptocurrency exchanges, Bitcoin ETFs are traded on stock exchanges.

Efforts for a Bitcoin spot ETF have been underway since 2013.

The Winklevoss twins applied for a Bitcoin spot ETF to the SEC, but it was rejected. Since then, numerous Bitcoin ETF applications have been denied.

In the past, it wasn't approved due to concerns about low trading volumes and price manipulation…

The market has grown, and the management system has been improved, so Bitcoin ETFs have finally been approved.

List of 11 Approved Bitcoin ETFs

I heard that 11 Bitcoin ETFs have been approved…

I'll briefly introduce the 11 approved Bitcoin ETFs.

What do Bitcoin ETF Tickers "BRRR" and "HODL" Mean?

| Ticker | Management Company |

|---|---|

| FBTC | Fidelity |

| GBTC | Grayscale |

| BTCO | Invesco&Galaxy |

| BTCW | WisdomTree |

| BITB | Bitwise |

| IBIT | BlackRock |

| ARKB | 21Shares & Ark Invest |

| EZBC | Franklin |

| BRRR | Valkyrie |

| DEFI | Hashdex |

| HODL | VanEck |

There are many tickers that include "BTC" or the name of the management company.

What do Valkyrie's "BRRR" and VanEck's "HODL" mean?

Both are memes (internet jokes) used in the Bitcoin community.

"BRRR" refers to the sound of printing money in large quantities, and "HODL" means to hold onto Bitcoin.

Eight Companies Including BlackRock to Conduct Custody on Coinbase

For Bitcoin ETF custody (storing Bitcoin), eight companies, including BlackRock, have chosen Coinbase, a major U.S. exchange. The other three companies have chosen different custodians: VanEck selected Gemini, Hashdex chose BitGo, and Fidelity will perform self-custody.

*Custody refers to the storage of cryptocurrencies by the ETF management company on behalf of investors.

*Self-custody means managing and storing assets by oneself.

Many management companies have chosen Coinbase, but are there any concerns?

While Coinbase has a solid track record, some are concerned about the concentration of Bitcoin in a single custody service, considering the risk of large-scale hacking.

Impact of Bitcoin ETF on Prices

I heard that the approval of Bitcoin ETFs also affected Bitcoin prices…

The prices of Bitcoin were indeed influenced during key events such as the listing of CME futures in 2017, the approval of Bitcoin futures ETFs in 2021, and the approval of Bitcoin spot ETFs in 2024.

Bitcoin Price Chart During the CME Bitcoin Futures Listing

CME stands for the Chicago Mercantile Exchange, one of the world's largest financial derivatives markets. Futures trading involves contracts to buy or sell assets at predetermined prices on future dates. When CME Bitcoin futures were listed in 2017, Bitcoin's price skyrocketed, only to plummet significantly afterward.

The anticipation that "Bitcoin might be accepted in traditional financial markets" led to more people buying Bitcoin, but the market also overheated significantly.

That year, the price rose from about 90,000 yen in January to over 2 million yen in December.

The CME futures listing might have marked the peak, prompting early investors to start selling.

It reminds me of the investment adage, "Buy the rumor, sell the fact."

Bitcoin Price Chart During the Approval of Bitcoin Futures ETFs

Bitcoin futures ETFs are investment trusts traded on stock exchanges, involving contracts to buy or sell Bitcoin at predetermined prices on future dates. About half a month after the approval of Bitcoin futures ETFs in 2021, Bitcoin hit an all-time high before the price started to decline.

In 2021, there were various positive developments such as Coinbase's NASDAQ listing and El Salvador's adoption of Bitcoin as legal tender, contributing to Bitcoin's price increase.

The cryptocurrency market was overall very active around the time of the Bitcoin futures ETF approval.

Bitcoin Price Chart During the Approval of Bitcoin Spot ETFs

In 2023, anticipation for Bitcoin spot ETFs was high throughout the year, with the cryptocurrency community eagerly awaiting approval.

Events During the Bitcoin Spot ETF Approval

- October 2023: A false report by CoinTelegraph about ETF approval led to a Bitcoin price surge.

→ The belief that "the price might surge upon ETF approval" created a bullish trend. - January 10, 2024 (JST): The SEC's Twitter account was hacked, falsely announcing "Bitcoin ETF approval," causing a price spike followed by a drop.

- January 11, 2024 (JST): Spot ETF was approved. Initially, there was no significant price movement, but prices briefly plummeted when trading began the following day.

The SEC's Twitter account was hacked!? That must have been quite an event…

Bitcoin prices are influenced by various factors, not just ETF events.

With the halving event coming in 2024, it's important to keep an eye on future Bitcoin price movements.

What Happens When Bitcoin ETFs Are Approved? Explaining the Pros and Cons

Bitcoin ETFs have finally been approved, but what changes once they are approved?

I'll introduce some of the pros and cons of the impact that Bitcoin ETFs can have.

Pros of Bitcoin ETFs

Bitcoin ETFs can be traded through regular securities accounts, enabling many investors familiar with traditional securities markets to participate in the Bitcoin market. As the market size increases and more funds flow in, this could potentially affect the price of Bitcoin.

ETFs are traded under strict regulations, which is why many investors participate in the market.

Institutional investors might also consider adding Bitcoin ETFs to their portfolios.

For those who find storing Bitcoin difficult, Bitcoin ETFs might be an easier investment option.

The application of existing regulatory and tax systems is also significant.

Cons of Bitcoin ETFs

While Bitcoin ETFs make it easier for investors to participate in the market, there is a risk that investors who do not fully understand the risks of Bitcoin investment may enter the market and be exposed to high volatility. Additionally, there are concerns about the concentration of Bitcoin in a single custodian service, as many fund managers have chosen Coinbase for custody services.

Moreover, just as there can be price discrepancies between gold and gold ETFs, there is a possibility that Bitcoin ETFs might also experience price discrepancies.

Fund managers handling Bitcoin ETFs are engaging in fee competition and promotions to expand their customer base.

It would be good if the risks of Bitcoin are well communicated along with its benefits.

Characteristics of Bitcoin Spot ETFs

Bitcoin spot ETFs are likely to experience more significant price fluctuations than futures ETFs, and their prices may change rapidly. Generally, it is said that "the spot market matures before the futures market develops." The main reasons Bitcoin futures ETFs were approved before spot ETFs are as follows:

- Concerns About the Circulation of the Spot Market

As seen in the FTX incident, illegal activities by key players like exchanges and brokers are prevalent. Additionally, the trading volume is not necessarily high enough. - No Need to Hold Physical Bitcoin

Futures are settled in cash, meaning the fund does not need to hold physical Bitcoin, avoiding the issues related to the security and management of physical assets. - Lower Risk of Liquidity Shortage

Futures trading does not require the actual asset, making the risk of liquidity shortage smaller compared to the spot market. - Lower Concerns Regarding Redemption

In the event of an unforeseen incident like a market crash, futures traded through exchanges can more reliably meet redemption demands.

Futures ETFs were approved first, and spot ETFs were approved about two years later…

But it doesn't mean there was a significant change like "Bitcoin's security and liquidity are now perfectly managed!"

Some voices say, "Now that Bitcoin spot ETFs are approved, next will be spot ETFs for other cryptocurrencies!" However, there are various opinions among experts, and the outlook is uncertain.

First, it's crucial to understand the differences between spot and futures characteristics and closely monitor the trends of Bitcoin spot ETFs.

Concerns About the Impact on Decentralization

Within the Bitcoin community, which values decentralization and privacy, some express concerns about Bitcoin ETFs.

Concerns About Bitcoin ETFs

- Do Not Promote Actual Bitcoin Ownership

Bitcoin ETFs only track the price movement and do not involve holding actual Bitcoin in personal wallets. - Centralization Concerns

ETFs are part of the traditional financial system, and the expansion of the ETF market is seen as contradictory to Bitcoin's decentralization. - Different from the Original Purpose

Bitcoin aims to build a decentralized and free financial system, and some believe that ETFs deviate from Bitcoin's original purpose.

With the approval of the Bitcoin ETF, "the price might go up!" but I also see what you mean about the concerns about centralization.

It's true that the approval of Bitcoin ETFs will make Bitcoin more widely known.

ETFs might spark more interest in Bitcoin among people.

Q&A About Bitcoin ETFs

I want to know more about Bitcoin ETFs.

I'll explain Bitcoin ETFs in a Q&A format.

Are the taxes for Bitcoin ETFs different from cryptocurrencies?

In Japan, Bitcoin is considered a cryptocurrency, while Bitcoin ETFs are treated as investment trusts, and the tax treatment is different.

- Cryptocurrency: Subject to comprehensive taxation. Income tax rates range from 5% to 45% depending on taxable income, with an additional 10% resident tax.

- Investment Trusts: Subject to separate taxation. Income tax is a flat 15.315%, with an additional 5% resident tax.

There are many calls for improvements to the tax system for cryptocurrencies.

I hope for future legal reforms.

Where can you buy Bitcoin ETFs?

Currently, Bitcoin ETFs cannot be purchased in Japan. The Bitcoin spot ETF was approved by the U.S. SEC and has not been approved in Japan.

If Bitcoin ETFs become available in Japan in the future, they will be traded through securities companies.

SBI and Rakuten also operate exchanges where you can buy Bitcoin, so it will be interesting to see how they handle ETFs.

Let's keep an eye on how Japan's legal framework for Bitcoin ETFs will evolve.

[Summary] Will Bitcoin ETFs Be Available in Japan?

Key Points

- Bitcoin ETFs have been approved in the U.S., but they cannot be traded in Japan.

- Bitcoin ETFs make it easier for many investors to participate in the Bitcoin market.

- There are concerns about the impact of Bitcoin ETFs on Bitcoin's decentralization.

It's disappointing that we can't buy Bitcoin ETFs in Japan yet, but hopefully, legal regulations will be revised so we can buy them someday.

I hope the approval of Bitcoin ETFs increases interest in Bitcoin.

Bitcoin seems complicated, but now I want to know more about it.

Let's learn more about Bitcoin!

Recommended Articles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.