Recently, I've been seeing a lot of blockchains and cryptocurrencies labeled as "Bitcoin Layer 2"…

In the world of cryptocurrencies, many projects attempt to ride the wave of buzzwords. In the past, numerous tokens have emerged claiming connections to DAO, DeFi, and NFTs.

Recently, there has been an increase in projects highlighting their connection to Bitcoin, leading to a proliferation of so-called "Bitcoin Layer 2" projects.

This article will explain why Bitcoin Layer 2 projects are on the rise and discuss the concerns surrounding the current spread of Bitcoin Layer 2.

Summary

- There is an increase in projects claiming to be Bitcoin Layer 2 to entice token purchases.

- Originally, Layer 2 referred to technology designed to enhance Layer 1 functionality in a trustless manner. Recently, the definition has been distorted, and some centralized projects on different chains with their own tokens are also claiming to be Bitcoin L2.

This article was written in Japanese and converted to English using a translation tool.

Date of writing (Japanese version): April 2024

What is Bitcoin Layer 2?

Bitcoin Layer 2 (L2 or Second Layer) refers to technologies or protocols built on top of Bitcoin's fundamental blockchain (Layer 1).

Protocol: A set of rules or procedures for exchanging data between computers.

Layer 2 primarily aims to improve Bitcoin's scalability and efficiency, enhancing the network's usability by speeding up transaction processing and reducing fees.

Scalability: The ability of a network to adapt to increased scale and usage load.

The term Layer 2 (Second Layer) was originally used as a concept to solve Bitcoin's scalability issues.

Later, the term Layer 2 started being used for other blockchains like Ethereum. Recently, there has been speculative interest directed toward Layer 2 projects.

Indeed, I have seen social media accounts advertising things like, "Pay attention to these Layer 2 stocks!"

Why Are Bitcoin Layer 2 Projects Increasing?

The rise in projects claiming to be "Bitcoin Layer 2" can be attributed to efforts to promote the purchase of unique tokens by leveraging their connection to Bitcoin.

Hmm, why are there more projects recently highlighting their connection to Bitcoin?

For major investors looking to play the money game, price strength is crucial.

Bitcoin is notable for its significant price increase among cryptocurrencies, and with the approval of the Bitcoin ETF in January 2024, it has become an exceptional asset.

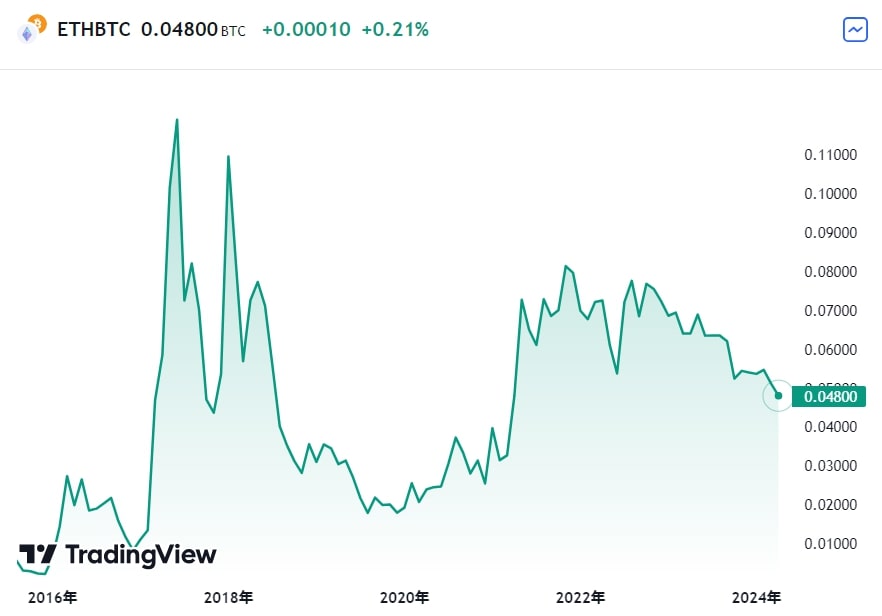

Ethereum (ETH) Price Relative to BTC

- June 2017: 1 ETH = 0.11 BTC (ETH/BTC highest price)

- April 2024: 1 ETH = 0.04 BTC

Ethereum's price has declined relative to Bitcoin.

Most altcoins have declined from their peak prices against BTC.

Top 20 Cryptos - Distance from ATH Against BTC

— リバタリマン (@libertariman) April 14, 2024

BTC建ての最高値からの下落率

軒並み80%近く下落

ETHも70%の下落

ビットコイン = 人類史上最も重要な発明の一つ

Shitcoin = 数クリックでチームが生成・情弱に売り浴びせ(ETH含む)

Buy bitcoin pic.twitter.com/IvYryvP9mE

Even altcoins that temporarily rose stronger than Bitcoin often decline in price against Bitcoin after a few years.

The Definition of Layer 2 Is Being Distorted

But Bitcoin is a network that anyone can freely participate in and develop, so it seems natural for Bitcoin Layer 2 to increase.

The problem is that the definition of Layer 2 is being distorted. What couldn't be called Layer 2 before is now increasingly being labeled as such.

Originally, Layer 2 referred to technologies that enhanced the functions of Layer 1 in a trustless manner and improved scalability.

Trustless: A system that functions without needing to trust a central authority or other third parties.

Example of Layer 2: Lightning Network

- Decentralized: Supported by numerous nodes run by users (over 12,000 nodes as of April 2024).

- No Central Authority: Developed and operated by independent developers and companies.

- Open Source: Anyone can participate and contribute to improvements.

- Uses BTC: No independent token; uses Satoshi (SATS), the smallest unit of BTC.

- Efficient Transactions: Allows sending small amounts of BTC quickly with minimal fees.

The term "Second Layer" was originally used for technologies like the Lightning Network that aimed to solve Bitcoin's scalability issues while maintaining a trustless state. Despite the difficulty in maintaining this trustless state, many developers have steadily advanced these technologies over the years.

However, many recent projects claiming to be Bitcoin Layer 2 have completely different characteristics, distorting the original definition.

Recent Examples of Bitcoin Layer 2

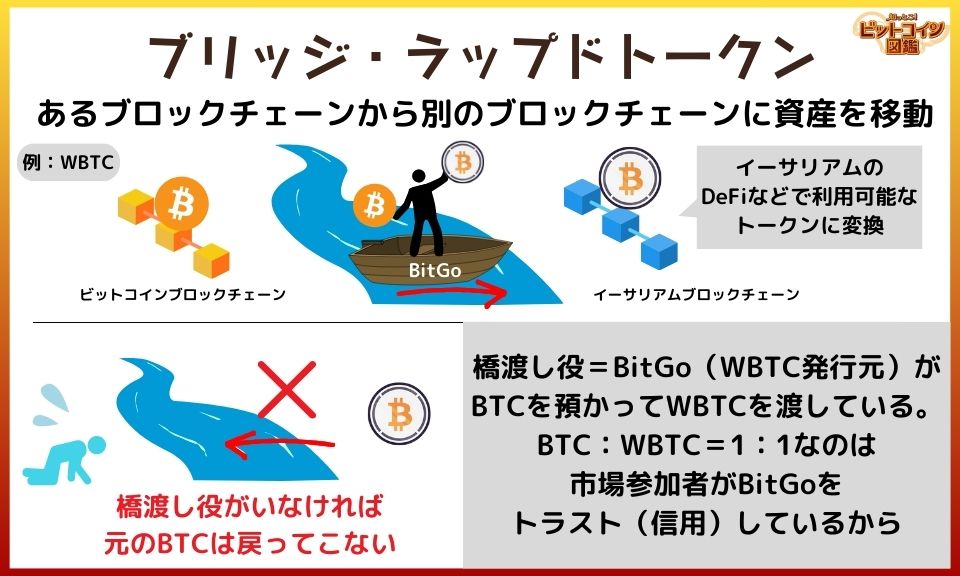

- Custodial Bridges: Centralized entities hold BTC and issue tokens on another blockchain, used for trading or DeFi operations.

- WBTC as Layer 2: Converts BTC to WBTC using a bridge, with original BTC held by BitGo, requiring trust in the operator.

Misleading Claims: These projects often claim a connection to Bitcoin but don't actually improve Bitcoin network scalability.

Originally, Layer 2 referred to technologies that aimed to improve Bitcoin's scalability, but now it seems to mean using Bitcoin on another chain.

Why has the definition of Layer 2 changed?

The rise of these projects is driven by the desire to engage in money games using Bitcoin.

The buzzword "Layer 2" is used to promote their tokens by implying a connection to Bitcoin, which is clearly a marketing tactic.

Many projects claim to be Bitcoin Layer 2 for marketing purposes. I often see media and influencers promoting these projects.

Many influencers now promote projects with "Bitcoin and [specific project or token]."

Back in 2017, many people did the same, spreading scam coin information alongside Bitcoin information, and attacking Bitcoiners who criticized these scam coins.

These people disappear once the trend is over, having used Bitcoin for their own gain.

They caused significant losses for many users and left a bad impression of Bitcoin, with people thinking "Bitcoin caused my losses!" or "Bitcoin is a scam!"

Beware of Layer 2 Hyped by Social Media and Media

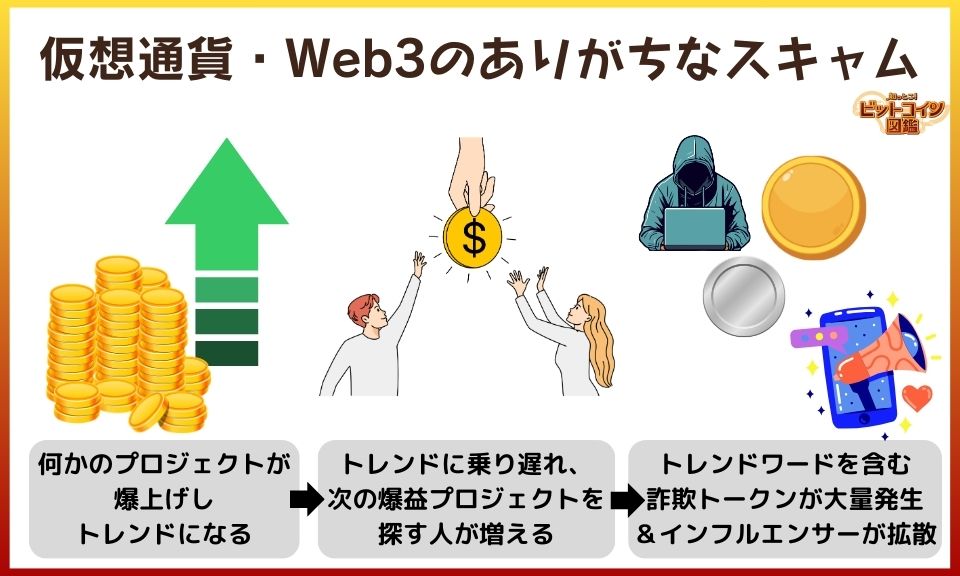

When a certain project skyrockets, similar projects often emerge and engage in heavy promotion. Many scam projects target people who missed out on popular tokens and are looking for the next big one, using various methods to siphon funds from users.

Recently, terms like "Bitcoin Layer 2," "airdrop," "meme coin," and "Ordinals NFT" have been trending. Even if a project mentions Bitcoin, don't let your guard down.

When I see profit reports on social media, I get the urge to jump in on tokens that seem promising…

I often see Web3 influencers promoting "Promising Airdrop" and get curious.

Web3 influencers promoting specific airdrops or projects often receive direct rewards from the project operators or affiliate commissions through referral links. Just because an influencer is spreading it doesn't make it safe.

But some might think, "If it makes money, who cares? Warnings are just annoying."

People wanting to play money games with crypto might want to pump the token and profit from it…

It's important to have people who say "No" when it's needed. Some might think twice and decide against it when they hear warnings.

With Bitcoin's price rising and more people starting to invest, it would be great if accurate information reaches more beginners.

Summary: Don't Be Fooled by the "Bitcoin Layer 2" Buzzword

Key Points

- Projects claiming to be Bitcoin Layer 2 and urging token purchases are increasing.

- Layer 2 originally referred to technologies that enhance Layer 1 functions in a trustless manner. Recently, the definition has been distorted, with centralized projects issuing tokens on separate chains calling themselves Bitcoin Layer 2.

Many projects advertise as "Bitcoin Layer 2" for marketing, even if they don't bring new technology.

Most projects issuing unique tokens are designed to profit the operators. Be wary of airdrops and influencer marketing.

Bitcoin seems complicated and makes me anxious, but I'm eager to learn more.

Let's learn more about Bitcoin!

Recommended Articles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.