What is BRC-20?

I heard it has something to do with Bitcoin…

BRC-20 is a new technology leveraging the Bitcoin blockchain that gained traction in 2023. While it has created new demand for Bitcoin, it has also caused problems, leading to divided opinions within the Bitcoin community.

In this article, I'll explain the features of BRC-20, how to buy it, and the issues arising from BRC-20.

Quick Summary of This Article

- BRC-20 is a token standard circulating on the Bitcoin blockchain.

- It currently has no clear use case and is traded mainly as a meme coin for speculative purposes.

- BRC-20 directly leads to higher Bitcoin transaction fees, sparking debate within the Bitcoin community.

Supervisor: Gottsu

Content manager at Diamond Hands

Distributes a newsletter on the Lightning Network.

Operates LN node sudachi🍋.

This article was written in Japanese and converted to English using a translation tool.

Date of writing (Japanese version): February 2024

What is BRC-20?

BRC-20 is a token standard circulating on the Bitcoin blockchain.

*Token Standard: A set of rules for creating and managing tokens on a blockchain.

Although the name resembles Ethereum's widely used token standard "ERC-20," BRC-20 lacks smart contract functionality and cannot perform complex operations like ERC-20 tokens.

*Smart Contract: A mechanism that automatically executes contracts according to predefined rules.

Currently, BRC-20 has no clear use case and is traded as a type of meme coin.

*Meme Coin: A cryptocurrency created as a joke without practical use.

I've heard that many common cryptocurrencies are based on the Ethereum blockchain…

Does this mean it's now possible to create them on Bitcoin too?

I've heard that many common cryptocurrencies are based on the Ethereum blockchain…

Does this mean it's now possible to create them on Bitcoin too?

Ordinals

"Ordinals" on Bitcoin is a protocol that assigns a unique number to each satoshi (sats) on the Bitcoin blockchain.

*Satoshi (sats): The smallest unit of Bitcoin. 1 BTC = 100 million sats.

Ordinals refers to the rules for assigning information such as "this satoshi was generated in the 55,000th block" to every satoshi.

Ordinals is a numbering scheme introduced in early 2023.

"Ordinals NFT," which involves storing images on the Bitcoin blockchain, quickly gained popularity.

A new mechanism called Ordinals emerged, and various ways to utilize Bitcoin were explored.

Additionally, data inscribed using the Ordinals mechanism, storing images or texts on specific satoshis, are called Ordinal Inscriptions.

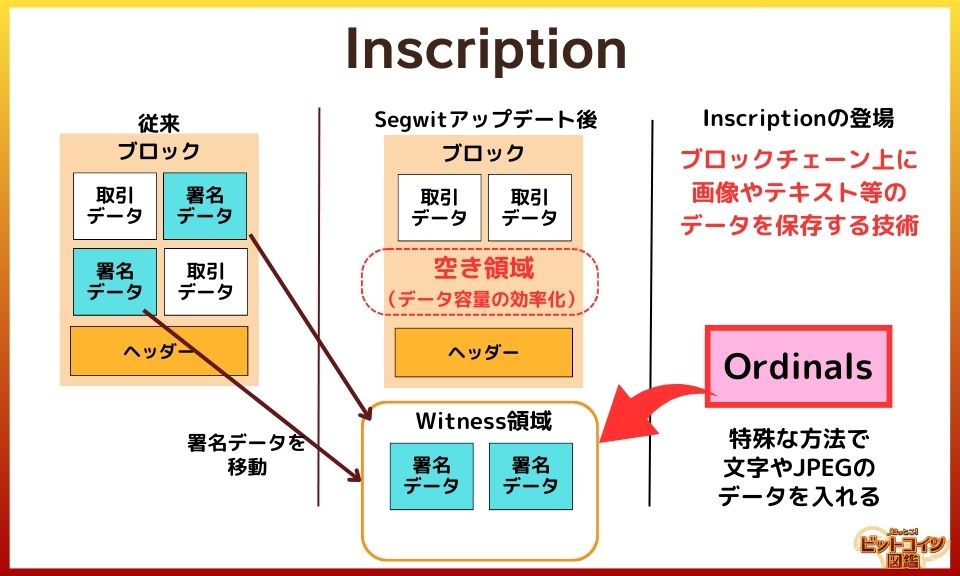

Inscription

"Inscription" refers to the technology of storing data such as images, text, and audio files on the Bitcoin blockchain.

*Inscription: An inscription (text carved on a monument).

The major Bitcoin update "Taproot," introduced in 2021, increased the amount of data that can be stored in contracts. By using specific methods, large data such as images can now be stored.

BRC-20 tokens are linked to text files written in JSON format, assigned numbers through Ordinals.

*JSON (JavaScript Object Notation): A data description language.

Taproot was an update aimed at improving scalability and enhancing privacy.

Ordinals and Inscription might be used differently from the original purpose of the Taproot update.

Differences Between BRC-20 and ERC-20

Although BRC-20 shares a similar name with ERC-20, it lacks smart contract functionality and has limited capabilities compared to ERC-20.

What You Can Do with BRC-20

- Token Creation: Deploy new cryptocurrencies.

- Token Minting: Issue new tokens for already deployed cryptocurrencies.

- Token Trading: Directly send tokens between individuals.

You can directly send BRC-20 tokens between users, but performing complex operations like DeFi with ERC-20 tokens is difficult.

For those used to working with the Ethereum blockchain, operations involving BRC-20 might feel a bit inconvenient.

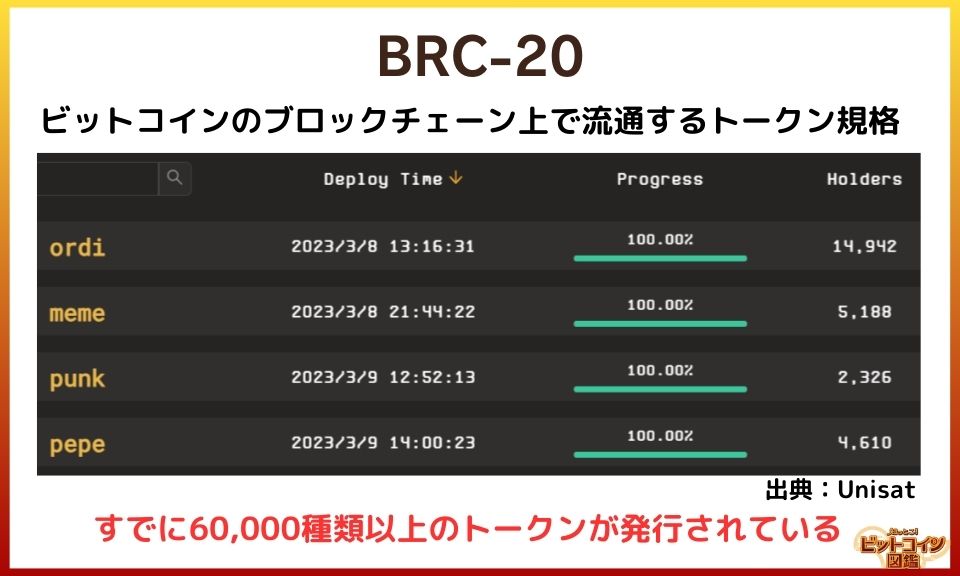

BRC-20は様々な銘柄が存在する

There are over 60,000 types of BRC-20 tokens.

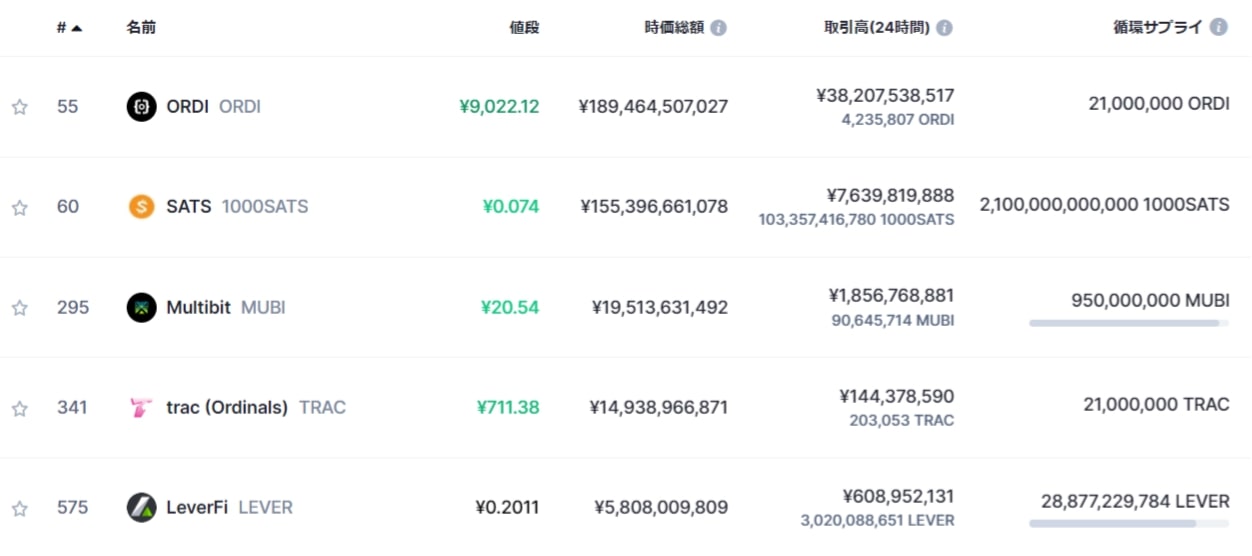

According to CoinMarketCap data, the tokens "ORDI" (ranked 55) and "SATS" (ranked 60) are within the top 100 by market capitalization. A total of five tokens are within the top 1,000, while the rest fall outside the top 1,000.

*As of January 31, 2024.

ORDI was the first BRC-20 token created and is relatively well-known among BRC-20 tokens.

Some BRC-20 tokens have high trading volumes, but many tokens are hardly traded or are nearly worthless.

Impact of BRC-20 on Bitcoin

I heard that problems have arisen since the introduction of BRC-20 tokens…

Here, I'll introduce the impact BRC-20 has had on Bitcoin.

Transaction Delays and Fee Increases

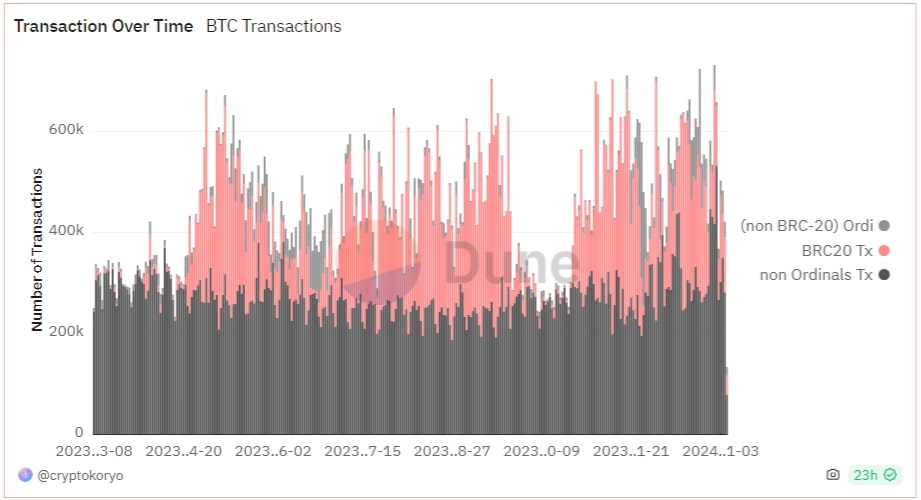

BTC Transactions (transaction data) count

Topmost gray: Ordinals (excluding BRC-20) Red: BRC-20 Black: Non-Ordinals

BRC-20 utilizes Bitcoin's block space, leading directly to increased transaction fees and delays in Bitcoin transactions. At one point, a large number of transactions were pending confirmation, and some cryptocurrency exchanges, like Binance, temporarily restricted Bitcoin withdrawals.

This has impacted Bitcoin's primary use for financial transactions, leading some in the Bitcoin community to view BRC-20 and Ordinals NFTs as problematic.

Additionally, the Ordinals protocol uses Taproot in a way that the developers did not intend.

In simple terms, it stores data in a "transaction data area" with fees that are a quarter of the cost, separate from the usual transaction data area.

It allows for sending large volumes of data at a lower cost than regular transactions!

For those who want to use Bitcoin as usual, the fee increases due to BRC-20 might be troublesome…

Factors Contributing to BRC-20 Fee Increases

BRC-20 tokens have a minting limit, so tokens expected to rise in price are minted competitively by investors. This results in a flood of transactions, causing transaction fees to spike rapidly.

Moreover, to mint tokens faster than others, transactions with higher fees rush in, further driving up transaction fees.

For BRC-20 tokens with a very high minting limit, a large number of transactions appear from people wanting to mint, causing the elevated fee rates to persist.

Many people send large numbers of transactions, hoping to mint when the fees drop.

The investor mentality of "I want to get tokens that might go up first!" is causing massive congestion in the Bitcoin network…

Beware of Speculative Movements

BRC-20 tokens are subject to speculative buying and selling, leading to rapid price spikes and crashes.

For example, the "PIZA" token mentioned above tripled in price over five days from December 12, 2023, but fell by more than half six days later and dropped to a quarter of its peak value two weeks after that. While Bitcoin itself is known for volatility, BRC-20 tokens are even more volatile and carry the risk of becoming worthless.

I've seen posts on social media and YouTube saying, "BRC-20 is hot! This token is recommended!"

Buying BRC-20 tokens without careful consideration could lead to buying at a high price and getting caught in a crash…

Not limited to BRC-20, altcoins often see a surge in reports of huge profits on social media during a bubble, which can mislead people into thinking they can make easy money.

However, it's often the case that social media hype marks the peak (high price), followed by a continuous decline.

Controversy in the Bitcoin Community

The Ordinals protocol and BRC-20 are also controversial within the Bitcoin community, with criticism from those who support traditional Bitcoin.

Proponents' Views

- Exploring new possibilities for Bitcoin

- Can engrave illustrations on-chain (cheaper than Ethereum)

- If transaction fees rise, miners' earnings increa

Opponents' Views

- Higher transaction fees and delays negatively impact regular Bitcoin transactions

- Increased cost for full nodes (network verification), potentially reducing network decentralization

- Attracting speculation to the Bitcoin network

Proponent: Domo (BRC-20 Creator)

gm. I'm glad that some people like the experiment. Some additional notes.

— domo (@domodata) March 9, 2023

1. These will be worthless. Please do not waste money mass minting.

2. Due to how some inscription tools are set up, the 'balance' may be minted to the intermediary address used in https://t.co/mja39YGIow…

Opponent: Luke Dash Jr (Bitcoin Core Developer)

PSA: “Inscriptions” are exploiting a vulnerability in #Bitcoin Core to spam the blockchain. Bitcoin Core has, since 2013, allowed users to set a limit on the size of extra data in transactions they relay or mine (`-datacarriersize`). By obfuscating their data as program code,…

— Luke Dashjr (@LukeDashjr) December 6, 2023

Just like speculative money is flowing into meme coins and NFTs, short-term speculative funds are entering Bitcoin through BRC-20.

Some people think the hype will eventually die down.

If Bitcoin prices rise and BRC-20 issuance and transaction fees increase, the benefits of handling BRC-20 for speculative reasons may diminish.

Additionally, some believe that the issues caused by BRC-20 and Ordinals might accelerate the development of payment technologies like the Lightning Network.

How to Buy BRC-20 Tokens in Three Ways

How can I buy BRC-20 tokens?

To get BRC-20 tokens, you can mint (newly issue) them on a dedicated platform, buy them on a marketplace, or purchase them on an overseas exchange.

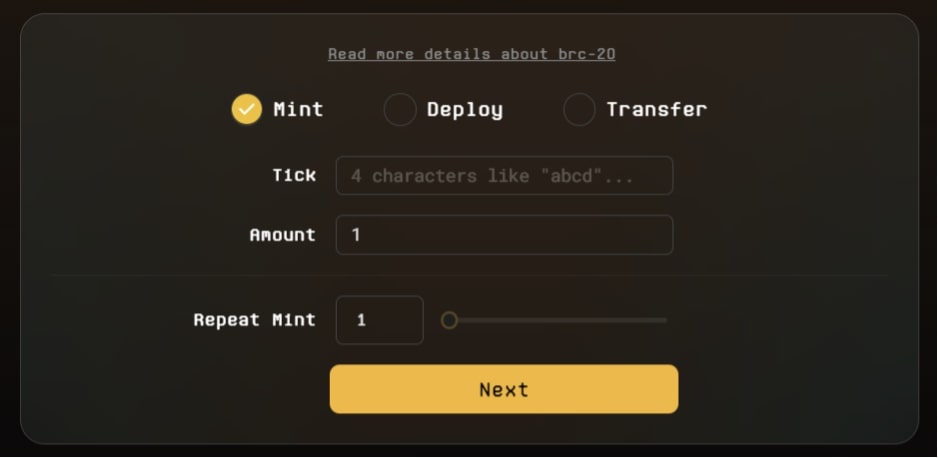

Minting BRC-20

Set the ticker and quantity of the token you want to mint

Set the ticker and quantity of the token you want to mint

Using marketplaces like Unisat, you can mint (newly issue) BRC-20 tokens. You can generate any token you like from the already deployed BRC-20s, or you can deploy new tokens yourself.

Process of Minting BRC-20

- Prepare a BRC-20 compatible wallet

- Send Bitcoin to the wallet address (for minting and fee costs)

- Choose and mint a token that hasn't reached its minting limit

Minting BRC-20 tokens incurs considerable costs, but speculative movements, expecting "returns greater than the cost," drive new issuances of BRC-20.

On social media, there are voices saying, "I couldn't mint tokens because of fee costs, and both the fee and minting costs were wasted," so it's best to check the latest information if you're considering minting.

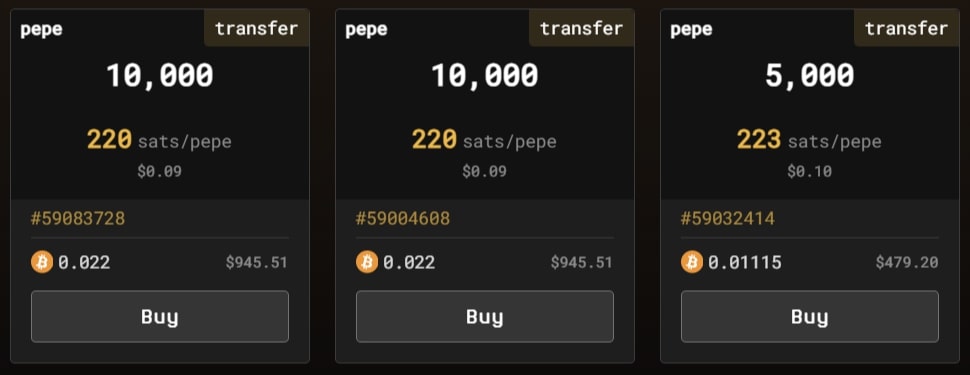

Buying BRC-20 on a Platform

The leftmost case shows "buying 10,000 pepe tokens for 0.022 BTC. 1 pepe = 220 sats"

Unisat has a marketplace for BRC-20 where you can buy BRC-20s listed. It operates like an over-the-counter transaction where buyers and sellers interact directly.

The atmosphere is quite different from a cryptocurrency exchange, so it might be confusing at first.

For tokens with extremely low prices per unit, the purchase quantity can be as large as 100 million units.

Buying BRC-20 on Overseas Exchanges

To buy BRC-20 tokens on a cryptocurrency exchange, you need to use an overseas exchange, as they are not available in Japan. For example, the global version of Binance offers trading in ORDI and SATS (1000 SATS).

I repeat, BRC-20 tokens fluctuate in price like meme coins.

Not everyone can catch the rise, and there's a possibility of a crash right after you buy them.

Just because they use Bitcoin's blockchain doesn't mean they move like Bitcoin in price.

If you don't consider BRC-20 tokens as completely separate from Bitcoin, you might incur more losses than expected.

Summary: BRC-20 is Highly Speculative!

Key Points

- BRC-20 is a token standard circulating on the Bitcoin blockchain

- It has no clear use and is traded for speculative purposes as a meme coin

- BRC-20 directly leads to a rise in Bitcoin transaction fees and is controversial within the Bitcoin community

At present, BRC-20 tokens are accelerating in speculative buying and selling. Prices can drop by more than half in just a few days, so trading them without careful consideration can be dangerous for beginners.

BRC-20 is a new technology in Bitcoin, but whether the trend will heat up further or fizzle out remains to be seen.

Bitcoin seems difficult and has many terms I don't understand, which makes me a bit anxious, but now I want to learn more about it.

Let's learn more about Bitcoin!

Recommended Articles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.