When is the halving of bitcoin? I'd like to know how the halving works.

Bitcoin has had multiple halvings, and in each case, the price has increased after the halving.

With the fourth halving coming up in April 2024, many are keeping a close eye on future price movements.

In this article, I'll explain bitcoin's next halving, historical charts, and what a halving is in plain English.

Supervisor: Atsushi Okada

Obtained a master's degree from Nagoya City University Graduate School through research utilizing data analysis.

In 2023, established a Bitcoin-native company in Japan to promote the Bitcoin ecosystem.

This article was written in Japanese and converted to English using a translation tool.

Date of writing (Japanese version): January 2024

What is the halving of bitcoin?

The price of Bitcoin after its halving is attracting a lot of attention, but what is the halving anyway?

Bitcoin's halving is when mining rewards are cut in half.

I'll explain mining and the halving in simple terms for beginners.

What is Bitcoin Mining?

I've heard that mining is a system where you get bitcoins…

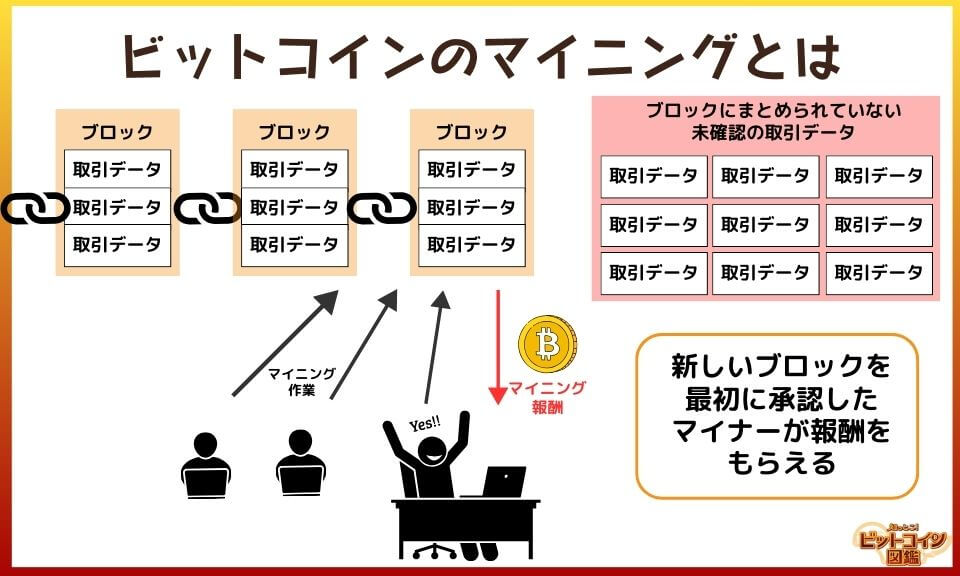

To put mining in a nutshell, it's the process of checking the transactions that take place on the bitcoin network and writing them correctly to the blockchain.

The first miner to find the numbers to approve a transaction gets bitcoins as a reward.

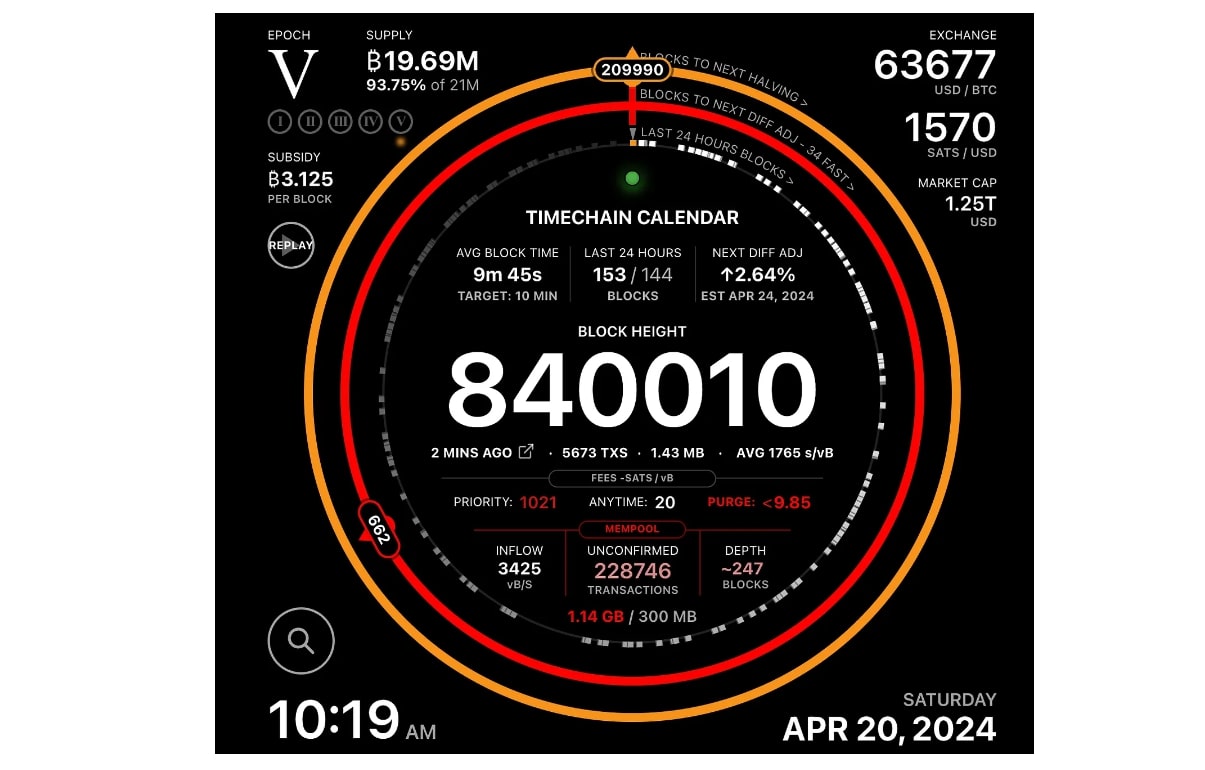

In Bitcoin, where there is no central controller, the issuance of new Bitcoins is done by mining. A new block is created every 10 minutes, or about 144 blocks per day.

Mining Flow

- Collection of transactions

→ Collect unconfirmed transactions made on the network - Verification of transactions

→ Verify that the sender has sufficient bitcoins, that the same bitcoins have not been used before, etc. - Formation of blocks

→ Collect verified transactions as a block of data - Adding blocks to the blockchain

→ Continue to calculate large numbers of transactions until it finds a number that matches the criteria

The first miner to find a value receives newly generated bitcoins and transaction fees.

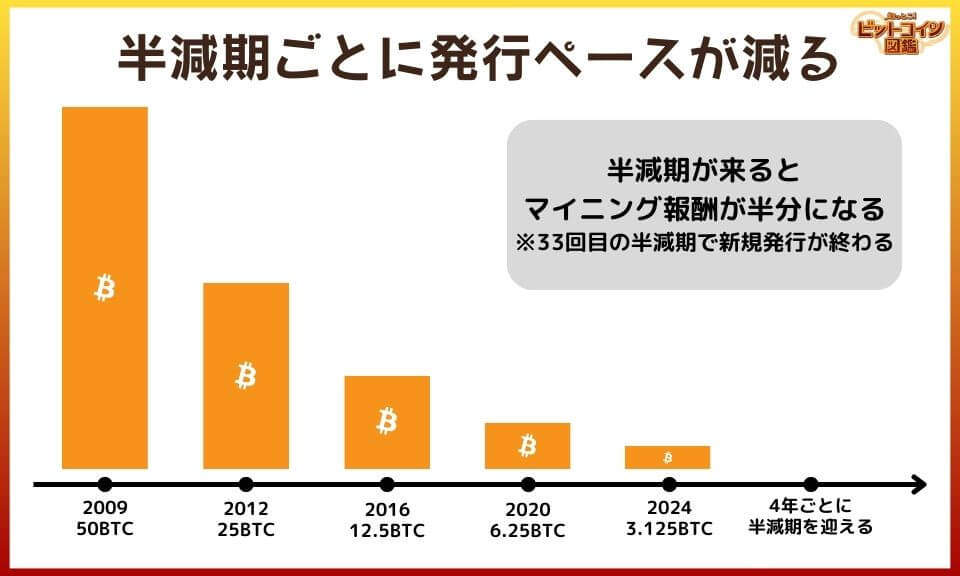

In the early days of bitcoin, you got 50 BTC as a reward for successful mining.

In the beginning, you had 7200 new bitcoins issued in one day!

Mining Block Rewards Cut in Half

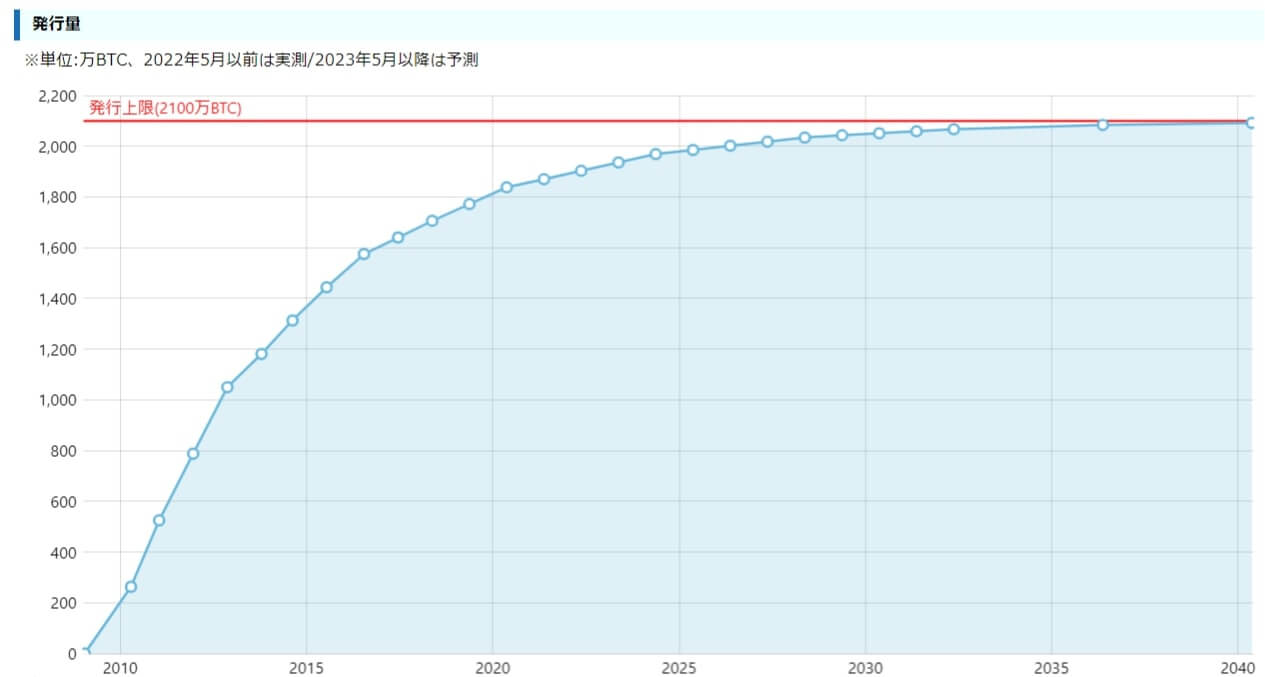

Bitcoin is programmed so that for every 210,000 blocks generated, the block reward for mining is halved.

This halving event has occurred automatically since bitcoin was issued, with a halving cycle approximately every 4 years. As of January 2024, the block reward is 6.25 BTC, and after the fourth halving, the block reward will be 3.125 BTC.

Reasons why bitcoin has a halving

- Maintains the scarcity of the currency

→ Prevents inflation by gradually decreasing the rate of new bitcoin issuance - Long-term value stability

→ Limited supply to 21 million coins, which stabilizes value over the long term

When a currency is issued in large quantities, it causes inflation and it loses value.

Bitcoin has a mechanism in place to prevent inflation by gradually decreasing block rewards.

I understand that there is a halving to prevent too many coins from being issued, but can't we just issue 21 million coins at once at the beginning instead of going to the trouble of reducing the amount issued at a certain cycle?

If all bitcoins were issued first, there would be no incentive for miners to mine. Mining keeps the bitcoin network alive by verifying transactions.

Also, if all bitcoins were issued at once, a large number of bitcoins would be circulating in the market, making the value of bitcoins unstable.

The end date for block rewards is around 2140

Block rewards decrease with each halving, and block rewards are scheduled to reach zero around 2140.

However, transaction fees will continue to be paid to miners even after the end of block rewards, which is believed to provide an incentive for miners to continue participating in mining.

Mining Rewards

- Block Reward

→ Awarded to miners who successfully add new blocks. New ones are issued, and the reward decreases approximately every 4 years. - Transaction fee

→ A fee paid when users send bitcoins; all transaction fees included in a single block are paid to miners who successfully mine the block.

If the mining reward goes to zero, you lose the block reward, but you still get the commission reward, so mining continues!

I guess if the price of bitcoin goes up and transactions become more active, commission fees may increase even more.

When was Bitcoin's halving in 2024?

Bitcoin reached its fourth halving on April 20, 2024.

Bitcoin reaches its halving every 210,000 blocks created, with each block taking an average of 10 minutes to create.

*210,000 blocks are generated in about 4 years.

The next halving is expected to be around April 2028.

You can check CoinGecko countdown site and other sites for updates on the expected halving dates.

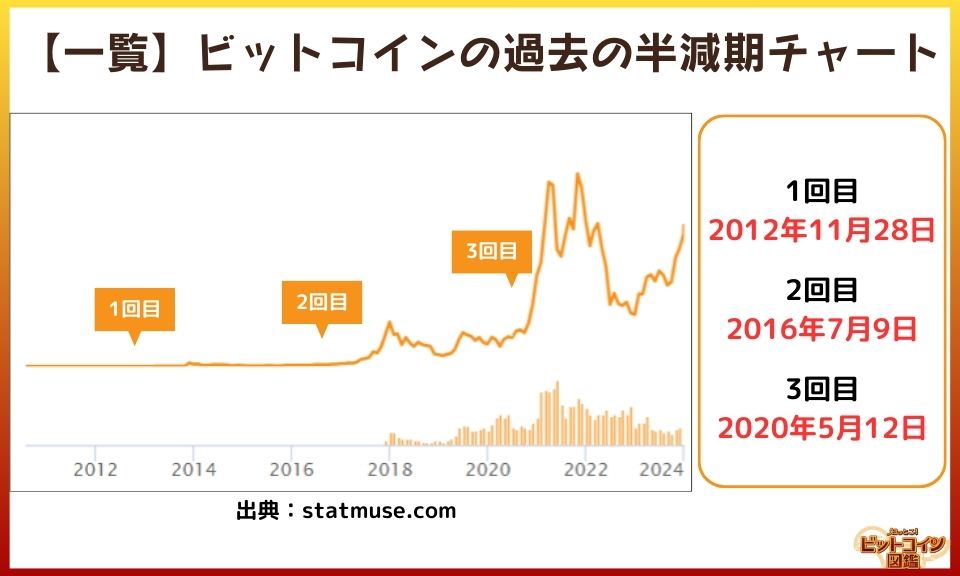

Bitcoin Historical Halvings

How has bitcoin's price moved in the past halvings?

Let's look back at bitcoin's price movements by checking the past halving chart.

Bitcoin halvings

- 1st: November 28, 2012

- 2nd: July 9, 2016

- 3rd: May 12, 2020

The reason why the first halving comes a little earlier than 4 years is due to the small number of miners in the early stages & the rapid increase in the number of miners, which shortened the block generation time.

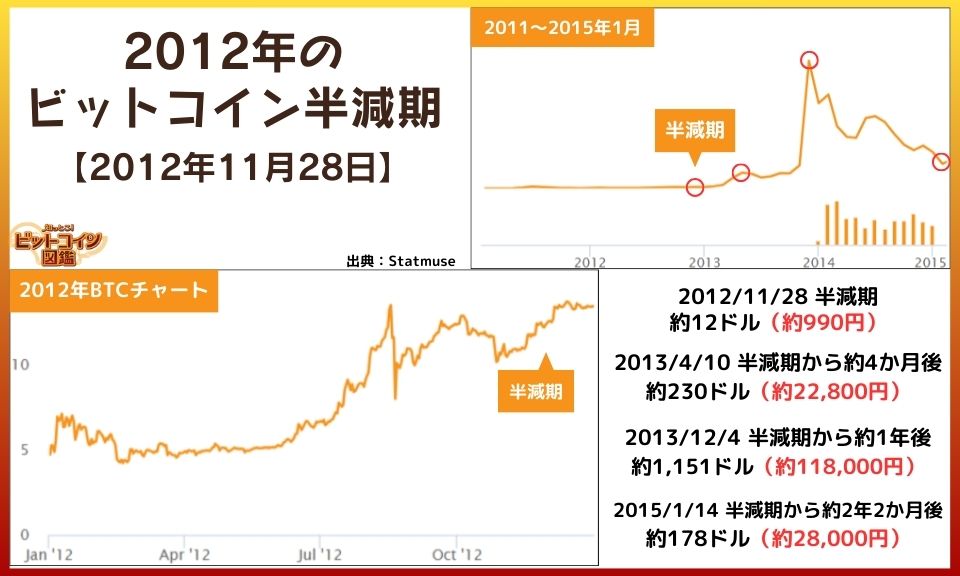

Bitcoin Halving in 2012

The first bitcoin block was generated on January 3, 2009, and the first halving of bitcoin occurred on November 28, 2012. Immediately after the halving, the price did not show much movement, rising about 1.1x in one month.

However, about four months after the halving, the price rose 19-fold, and about one year after the halving, the price soared to nearly 100-fold. After reaching its peak in December 2013, the price dropped by about 75% over a period of around one year and one month.

In the early days of Bitcoin, you had a tremendous surge!

In early 2013, the Cyprus crisis led to a loss of confidence in legal tender, and bitcoin became the focus of attention as a refuge currency.

In late 2013, bitcoin speculation among Chinese people increased and a special program on bitcoin was broadcast on NHK news in Japan, which caused the price of bitcoin to rise.

Bitcoin Halving in 2016

Bitcoin's second halving was July 9, 2016.

Not much price volatility occurred immediately after the halving, with the price falling by about 20% a month later, but then rising. In the one year and five months since the halving, the price has soared 30-fold. After reaching its peak in December 2017, prices dropped around 83% in about a year.

Another post-halving bubble!

It's possible that in late 2016, with the election of President Trump, people invested in bitcoin because they were worried about a weaker yuan.

Late 2017 was a time of yen-driven virtual currency buying, and many people got into bitcoin because of commercials for virtual currency exchanges.

Bitcoin Halving in 2020

Bitcoin's third halving is May 12, 2020.

*May 11, US time.

The decline about two months before the halving is attributed to the Corona shock, which caused the entire financial market to fall sharply. Seven months after the halving, it had risen about 3x, and 18 months after the halving, it had risen about 8x. It reached a record high in November 2021, and about a year later (at the end of the following year), it had fallen by about 70%.

The rate of increase is smaller than the first and second halvings, but the rate of decline from the peak is also smaller!

The price movement seems to be more stable than in the beginning.

In late 2020, we saw the entry of U.S. companies into the Bitcoin market in earnest, with MicroStrategy starting to buy Bitcoin and PayPal Block (formerly Square) starting its Bitcoin business.

In 2021, Tesla's entry, El Salvador's Bitcoin becoming legal tender, Bitcoin futures ETF approval, and much more were in the news.

Why go up? The Impact of Bitcoin's Halving

Bitcoin seems to have a tendency to rise after its halving, but why does it go up?

Price movements are caused by a combination of various factors, such as the withdrawal of miners, the entry of institutional investors, and global monetary policy moves.

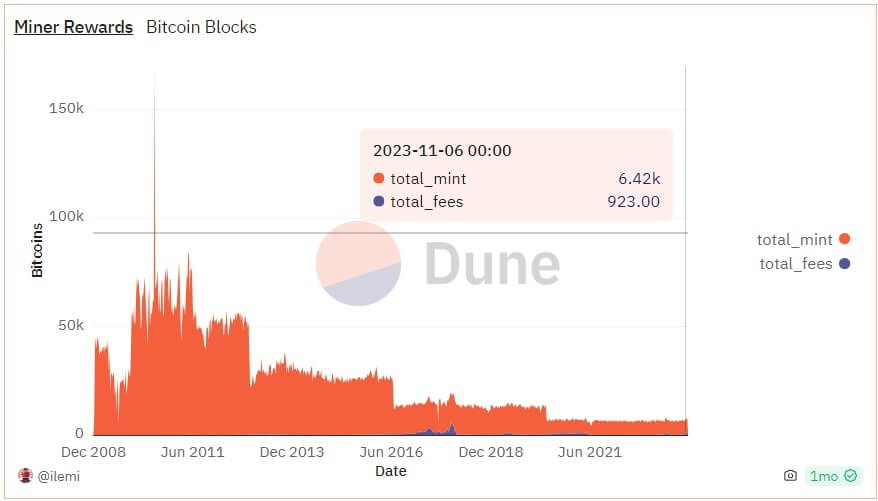

Here, I will explain the selling pressure associated with the sale of bitcoin by miners as an event seen around the halving of the market.

Before the Halving: Miners' Selling is Alarming

Red: block fee for new issues Blue: transaction fee

Since the halving reduces block remuneration by half, some miners whose earnings are not commensurate may withdraw from the business. Some people believe that upon exiting the business, miners will sell a large amount of bitcoins in their holdings, which will destabilize the bitcoin price.

*Miners need to convert bitcoin into cash to pay for electricity and equipment costs, and they believe that bitcoin held by miners is under selling pressure.

Mining is expensive, and the cost of electricity to run the machines and facility maintenance is very high, so some miners are exiting the business around the halving of the mining business.

Taking into account the contractual arrangements for facilities and electricity costs, some miners may withdraw from the business a few weeks or months after the halving, and it is possible that the sale of bitcoins by miners who plan to withdraw will continue for some time.

Even with the halving so far, it wasn't like, "It skyrocketed at the same time as the halving!" It wasn't like that, was it?

The countdown event may be exciting, but we should pay attention to the price fluctuation.

After the Halving: Selling Pressure is Expected to Decrease Due to Lower Issuance

As bitcoin issuance decreases due to the halving, the supply of new bitcoins on the market will decrease as miners sell fewer bitcoins. As a result, bitcoin will become more scarce, which may lead to higher prices.

Miners that run at a loss will be weeded out, and those in areas with low electricity costs and strong miners with the latest equipment will survive.

Maybe the remaining miners will be able to keep their earnings due to the departure of their competitors and have more room to hold on to their bitcoins without cashing them in.

If miners are weeded out, the selling pressure on bitcoin will decrease, which may help stabilize the price!

Experts' Price Predictions for Bitcoin's Halving

Here are some bitcoin price forecasts from bitcoin experts and bitcoin-related companies.

Price Forecasts Before and After the Halving

- Pantera Capital (a major U.S. virtual currency venture fund)

→ About $35,000 before the April 2024 halving and $148,000 after the halving - Matrixport Research (digital asset management and financial services company)

→ $63,140 by April 2024 and $125,000 by year-end - Bitwise (U.S. virtual currency investment company)

→ Over $80,000 by 2024 - Standard Chartered Bank (international bank based in London)

→ Over $100,000 by the end of 2024

The highest price recorded in 2021 was about $69,000 (about 7.6 million yen at that time rate).

As of January 4, 2023, it was at about $42,000 (about 6.2 million yen).

So many people are predicting a price increase after the halving and a new high in 2024!

A Question and Answer on Bitcoin's Halving

I wish I know a lot more about bitcoin's halving.

I'll answer about the halving of bitcoin in a question-and-answer format.

Could the halving of bitcoin be accelerated?

If the average time for Bitcoin block generation (theoretically 10 minutes) is consistently slightly shorter, it is possible that it could be slightly earlier than the expected date and time.

It should be noted that the bitcoin system is designed to adjust the mining difficulty approximately every two weeks so that the block generation time approaches 10 minutes, so the halving is not expected to be significantly earlier.

We've reached our fourth halving on April 20, 2024.

At present, the next halving is expected to be around April 2028.

Other virtual currencies don't go up in their halving?

There are other virtual currencies that have halvings, like bitcoin, but it is difficult to predict whether the halving will directly lead to a price increase.

Some traders buy and sell with the expectation of a rise around the halving, but keep in mind that the uncertainty of price fluctuations is even greater than with bitcoin.

Litecoin, Bitcoin Cash, and Monacoin are some of the virtual currencies that have halvings.

Altcoins with small market capitalization tend to get a lot of attention for blowing up, but they also have a great way to crash….

It's important to remember that the risk is much greater than with Bitcoin.

What is the halving of Bitcoin Cash?

The next halving of Bitcoin Cash is expected in early April 2024.

The previous halving was April 8, 2020, which is slightly earlier than Bitcoin's May 12, 2020 halving.

Bitcoin Cash is a virtual currency that branched (forked) from Bitcoin, right?

Why does Bitcoin Cash have a faster halving than Bitcoin?

Right after the split, there was a period of time when Bitcoin Cash block generation times were fast.

There was a period of time when Bitcoin Cash was generated as fast as once a minute, compared to Bitcoin where a block is generated once every 10 minutes, which is one of the reasons for the shift in halving.

[Summary] When is the halving of bitcoin?

key points

- Halving is when the block reward for mining is halved.

- Bitcoin reaches its fourth halving on April 20, 2024.

- In the previous three halvings, the price has risen after the halving.

So every time bitcoin reaches halving, the number of new issues is decreasing, which keeps the currency scarce.

In previous cycles, prices have risen after the halving, so many people are expecting the next halving to be the same.

I was kind of nervous about bitcoin because it sounds kind of difficult and I don't really know what it is, but I wanted to know more about it.

I want to know more about Bitcoin!

Recommended Articles:What is Bitcoin?

Writer:Sigeru Minami

Creator of "Bitcoin-zukan.com."

Active as a handmade craftsman of Bitcoin goods.